GCC Healthcare Growth: Innovation, Investment and Challenges

The GCC Healthcare industry is booming, fueled by demand for quality services and capacity building programs, contributing to its significant growth.

Governments are pushing healthcare regulatory reforms, including public-private partnerships, expanded health insurance, and collaborations to close the demand-supply gap. A new report by Alpen Capital – IMAP GCC, looks at the key drivers, challenges, and trends shaping the Gulf Cooperation Council Healthcare sector, offering insights into healthcare investment opportunities in the region. This article gives an overview of areas covered in the report including some observations from professionals in the sector interviewed by Alpen Capital.

Healthcare at the Forefront of National Visions

Healthcare in the Gulf countries is evolving, driven by demographic shifts and government initiatives. National visions like Saudi Arabia's Vision 2030 and the UAE's Centennial 2071 prioritize the sector.

Frameworks across the region emphasize:

-

Modernization

-

Private sector participation

-

A patient-centric ecosystem

This translates into substantial healthcare infrastructure investment, with a focus on specialized facilities and Healthcare technology integration. As John Sunil, CEO of Burjeel Holdings, UAE, points out, “The region’s growing acceptance of digital healthcare solutions, coupled with the strategic alignment of public-private partnerships, positions the GCC as a global leader in healthcare delivery.”

GCC countries are heavily investing in these areas, aiming to modernize healthcare and boost private sector involvement. Kimberley Pierce, CEO of King’s College Hospital, UAE, highlights, “The region’s focus on building state-of-the-art infrastructure, fostering collaboration between public and private sectors, and addressing specific community health needs is positioning the GCC as a global healthcare hub.”

Demographics, Disease, and Digital Disruption Drive Growth

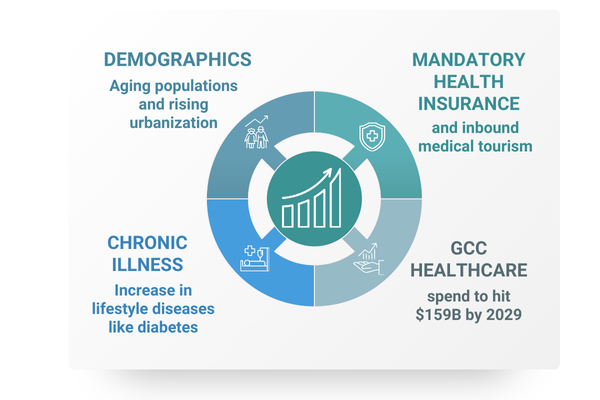

Several factors are driving the GCC Healthcare market forward including economic growth and diversification, favorable demographics and a growing burden of disease. Mandatory health insurance, inbound medical tourism, and a robust project pipeline all contribute. Aging populations and increasing urbanization are boosting demand for services.

The rise in lifestyle-related diseases like diabetes and cardiovascular conditions is also creating opportunities for chronic disease management companies.

The region's expanding population, high incidence of non-communicable diseases, and rising treatment costs are expected to drive growth. Dr. Mohaymen Abdelghany, CEO of Fakeeh University Hospital, notes that, “Growth in this sector will be driven by preventive healthcare focus, personalized medicine, and value-based care models, alongside advances in pharmaceutical manufacturing and medical research.”

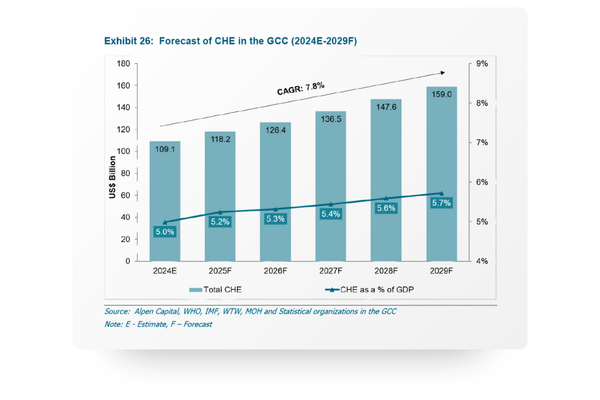

Spending Soars: Projections and Market Dynamics

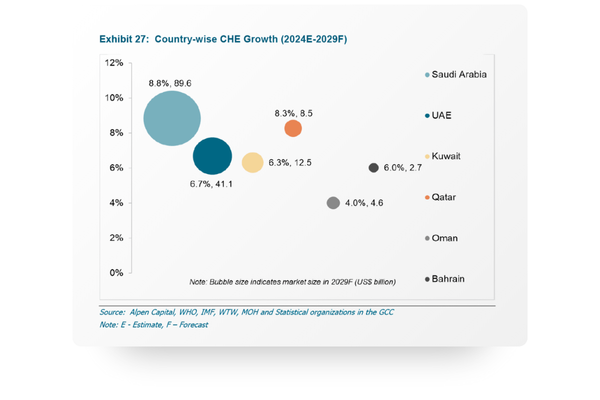

Healthcare expenditure in the GCC is projected to reach USD 159.0 billion in 2029, a CAGR of 7.8% from 2024. Furthermore, as a proportion of GDP, this expenditure is expected to increase from 5.0% in 2024 to 5.7% in 2029.

-

Saudi Arabia is projected to have the highest healthcare expenditure growth rate at 8.8% CAGR. This is largely driven by an expanding and aging population base, wider coverage of mandatory health insurance, and high average medical inflation rate

-

Saudi Arabia and the UAE are anticipated to account for 82.6% of the region’s healthcare expenditure in 2029

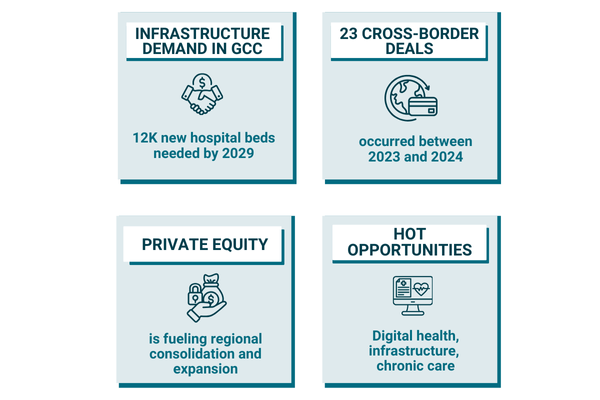

The GCC will likely require 12,317 new hospital beds by 2029, translating to an annual growth of 1.9% to reach a collective capacity of 140,572. Saudi Arabia will likely need over 8,500 new beds, accounting for approximately 69.0% of the region’s total additions.

The annual average growth rates of healthcare expenditure in the GCC countries are projected to range between 4.0% and 8.8% during the forecast period. The growth varies widely among the GCC nations largely owing to country-specific population projections, economic conditions, cost of healthcare, and prevalence of underlying diseases among other factors.

AI Revolutionizes Healthcare: Diagnostics and Beyond

AI-powered diagnostics are transforming healthcare. From AI-based diagnostics to conversational AI, the potential applications are vast. These technologies improve clinical outcomes and streamline administrative processes. Experts emphasize training AI tools on regional data for accuracy. Hein van Eck, CEO of Mediclinic Middle East, comments “it is critically important that AI tools in the GCC are trained on regional, not generalized global, data.”

AI will aid early disease detection and personalize treatment plans, while automation will reduce human error. Early adoption will focus on low-risk scenarios with careful clinical decision support.

Mr. Sunil of Burjeel Holdings notes that “Burjeel embraces innovation and advanced medical technologies, such as AI-powered diagnostics and precision medicine, to transform patient outcomes and operational efficiencies.”

Telemedicine: A Cornerstone of Modern Healthcare Delivery

Telemedicine has become an important part of care delivery in the GCC region, with growing patient demand for convenient, remote healthcare options. This digital health innovation is improving access to care, particularly in remote areas.

The expansion of telemedicine services is part of a broader trend of digital transformation in the GCC Healthcare sector, which also includes the adoption of AI-powered diagnostic tools, predictive analytics, and healthcare data analytics.

These technologies are not only enhancing patient care but also improving operational efficiency in healthcare delivery. The rapid adoption of telemedicine in the GCC is a testament to the region's commitment to leveraging technology to improve healthcare accessibility and quality.

Navigating Challenges: Costs, Workforce, and Regulations

Despite the promising outlook for GCC healthcare growth, the sector faces hurdles including:

-

Healthcare workforce challenges - Recruiting skilled professionals is difficult, reliant on expats and requires investments in talent development

-

High dependency on imports – the Healthcare sector has high exposure to price fluctuations for pharmaceuticals, medical devices, and equipment

-

Limited special care facilities – a focus on primary and secondary care means there is a gap in specialized care demand

-

Rising healthcare cost management – driven by geopolitical concerns and gloomy economic environment, coupled with lingering global supply chain disruptions and labor shortages

Harmonizing healthcare regulatory reforms is essential. As Hein van Eck, CEO of Mediclinic Middle East, notes, “Pressures regarding affordability are mounting as the demand for services escalates”.

This requires a strategic alignment of premium services with cost-effectiveness.

Trends to Watch: Privatization, Precision Medicine, and Specialization

Several key trends are shaping the future of GCC Healthcare:

-

Privatization initiatives and Public Private Partnerships (PPPs)

-

AI and automation transforming continuum of care

-

Genomics and precision medicine advancements

-

R&D Initiatives and pharmaceuticals manufacturing

-

Shift towards preventive care management

-

Growing number of specialized Centers of Excellence

-

Growth in aging population healthcare and specialized care services

Investment Opportunities: A Fertile Ground

The GCC Healthcare market offers a wealth of investment opportunities across various segments:

-

Healthcare infrastructure projects

-

Digital health solutions

-

Chronic disease management

-

Healthcare solutions in UAE and other GCC countries that leverage technology

The region's ambition to become a medical tourism hub is also driving investment. Strong government-backed initiatives and strategic public-private partnerships are key factors driving the future growth of the GCC’s Healthcare industry.

Mergers and Acquisitions: Consolidation and Expansion

In 2023, the sector recorded 16 M&A deals compared to 17 concluded the previous year, and in 2024 only 8 transactions were completed amid growing macroeconomic and geopolitical concerns. Global market uncertainty has prompted businesses to prioritize organic growth and operational efficiency over aggressive expansion through acquisitions.

Majority of the deals concluded in the last two years focused on creating synergies, enhancing operational capabilities, strengthening services portfolios, and expanding market reach.

While some of the deals were organic in nature, primarily aimed at forming stronger entities to offset weak profitability, the region witnessed active participation from Private Equity players and alternative investment firms.

Investors have played a crucial role in both regional consolidation and supporting local companies' international expansion, leading to more diverse portfolios. The deals during this period varied from full acquisitions to strategic investments, with many companies capitalizing on growth prospects. The region experienced a notable number of cross-border transactions, with 23 deals occurring within the GCC in 2023 and 2024. Additionally, there were two instances where foreign operators acquired stakes in GCC healthcare establishments.

Some significant operations in 2023 and 2024 were Fajr Capital Limited’s acquisition of Aster DM Healthcare FZC for USD 1001.8 million, Abu Dhabi Health Services Company PJSC’ acquisition of Sheikh Shakhbout Medical City LLC for USD150 million and BinDawood Holding Co’s acquisition of Zahrat Al Rawdah Pharmacies LLC for USD 118.3 million.

Hein van Eck of Mediclinic Middle East observes, “The sector is witnessing notable consolidation among payers and providers, and a pronounced focus on aggressive expansion in Saudi Arabia. This trend signifies a strategic initiative for market diversification, as healthcare organizations aim to expand beyond current borders.”

The GCC Healthcare sector is poised for continued growth, driven by strong fundamentals and innovation. Addressing challenges related to costs, workforce, and regulations is essential. By embracing digital health, investing in infrastructure, and fostering partnerships, the GCC can uphold its reputation as a world-class healthcare system with a patient-centric healthcare approach. At Alpen Capital, we believe the outlook for the GCC Healthcare market is promising and offers opportunities for value creation and long-term growth.

If you are interested in reading the full GCC Healthcare Industry report prepared by Alpen Capital, you can find it here.