Haykala, IMAP’s Partner in Saudi Arabia Helps Clients Make the Most Of the Country’s Ambitious Vision 2030

Haykala's Managing Director, Hisham Ashour shares his views on why Saudi Arabia is highly attractive for investors and what key trends are behind deal activity.

A Solid Mid-market M&A Firm

Founded in 2020 by a team of professionals with many years of experience in corporate finance, Haykala is one of the leading mid-market firms in Saudi Arabia. The boutique has offices in Riyadh and Dammam with seven advisors and specializes in assisting family businesses with sell-side and buy-side advisory services. They provide comprehensive support for businesses preparing for IPOs on the Tadawul and Nomu markets. Additionally, Haykala helps family businesses transition to corporate structures, ensuring proper corporate governance is in place.

The Growing Importance of Saudi Arabia

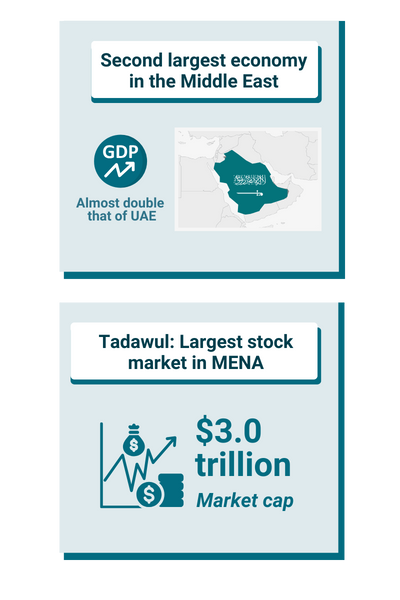

Saudi Arabia is the second biggest economy in Middle East after Turkey, with almost twice the GDP of the UAE which comes in third. In terms of population, with around 35,000 people, it is almost the same size as Canada. The Tadawul, its main stock exchange, is the largest market in the MENA region, and is among the top 10 capital markets in the world, with a market cap of $3.0 trillion.

Saudi Arabia’s Vision 2030: A Moment of Opportunity

In 2016, Saudi Arabia launched an ambitious roadmap for economic diversification, global engagement, and enhanced quality of life, called Vision 2030. In the years since its launch the country has undergone an economic and cultural transformation while also remaining true to itself.

The market outlook is very positive as the government is focused on Vision 2030, which involves investment in different sectors to reduce the country’s dependence on oil, and a liberalization of Foreign Direct Investment. The government has introduced many measures aimed at enhancing the business environment within the kingdom and making it more attractive to do business there, simplifying procedures and offering companies greater incentives.

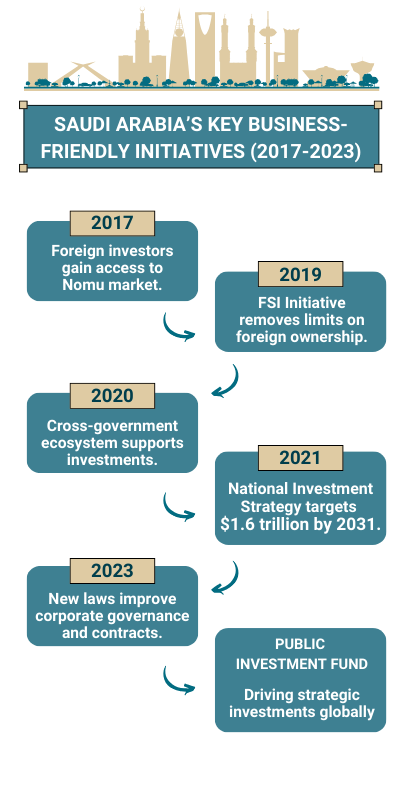

Some of the business-friendly initiatives introduced include:

-

In 2017, foreign investors were granted access to the Nomu, Saudi Arabia’s parallel market, on similar terms as local investors

-

In 2019, the government introduced the FSI Initiative whereby existing limitations on foreign ownership of Saudi Arabian-listed companies for foreign strategic investors were eliminated

-

In 2020, a cross-government ecosystem was established to support local and foreign company investment, providing market research, investment advisory, and government liaison capacities.

-

In 2021, the National Investment Strategy Initiative was launched to attract 1.6 trillion in foreign investment to the Kingdom by 2031

-

In 2023, Saudi Arabia introduced both the new Company Law and the Civil Transactions Law. The first, was a comprehensive review of the regulation of all forms of entities aligned to the Vision 2030 Objectives and the second was a major milestone for companies as it greatly improves the regulation of contract law, providing increased certainty to individuals and companies

In addition, Saudi Arabia's sovereign wealth fund, the Public Investment Fund is pivotal in driving strategic investments. Its focus on both domestic and international opportunities broadens the scope of M&A activities and attracts global partnerships.

Trends in M&A Activity

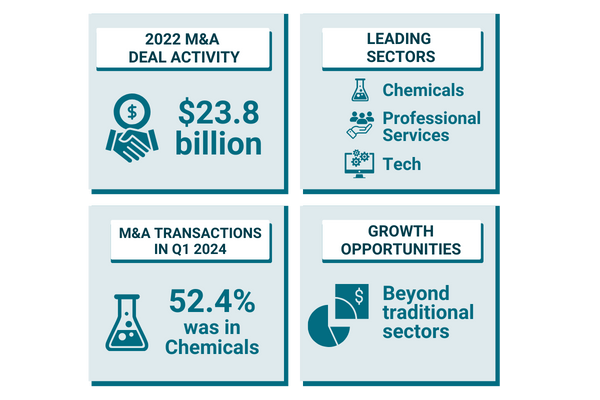

The government’s initiatives to privatize, attract FDI, and reduce reliance on oil have boosted M&A deal activity exponentially with deal activity rising to $23.8 billion in 2022. While global economic pressures caused a decrease in activity in 2023, the outlook for Saudi Arabia’s M&A market remains positive.

Leading the charge in the first quarter of 2024, Saudi Arabia dominated the Middle East's Chemicals sector with $500 million in deals, accounting for 52.4% of the Kingdom's total M&A activity. This dominant position underscores the sector's strategic significance within the region's economic landscape.

Emerging as the second most active sector, Professional Services contributed $160 million in deals, representing 16.8% of the total M&A activity. This robust performance highlights the growing sophistication and diversification of Saudi Arabia's economy beyond traditional sectors.

The Technology sector closely followed with $138 million in deals, capturing 14.5% of the market share. Additionally, the Retail and Insurance sectors made substantial contributions, accounting for 7% and 4.1% of the total M&A activity respectively, showcasing the breadth of Saudi Arabia's economic transformation.

Recent Transactions Haykala has Advised on

Haykala played a pivotal role in the restructuring of Azmeel sukuk issuance, which involved a 7.73 billion Saudi Riyal ($2.06 Billion) debt primarily through the issuance of perpetual Islamic bonds. This innovative financial instrument, a quasi-equity tool, enables the company to settle its obligations over an extended period using a cash sweep mechanism in favor of the creditors. Notably, this was the first perpetual sukuk issuance in the Middle East with approval from the Capital Market Authority (CMA).

Another key transaction Haykala advised on was the restructuring of Arkad, a leading EPC Oil & Gas contractor based in Dammam. Arkad managed to secure the support of 86% of its creditors for its restructuring plan of SR 3 billion under the court-supervised Financial Restructuring Process (FRP). Haykala was appointed as the Restructuring Advisor and Chief Restructuring Officer (CRO).

With strategic initiatives and supportive measures in place, Saudi Arabia’s M&A market is poised for a dynamic and prosperous year ahead, reflecting the Kingdom’s commitment to economic diversification and sustainable growth. Haykala’s highly experienced team of experts is ready to support national and international companies make the most of these initiatives.