Irish Whiskey and the Global Market: Growth and Opportunities

The Irish Whiskey industry has emerged as one of the most dynamic segments within the global spirits market, driven by a resurgence in domestic production, increasing international demand, and a focus on premiumization.

With its rich heritage and a rapidly expanding footprint, Irish whiskey is poised to capitalize on global growth opportunities, making it an attractive proposition for both producers and investors alike.

A Legacy of Craftsmanship: The History of Irish Whiskey

The history of Irish whiskey is deeply intertwined with Ireland's cultural and economic evolution, stretching back over six centuries. The first written record of Irish whiskey dates to 1405, as documented in the Annals of Clonmacnoise. By the 1700s, distilleries such as Bushmills and Kilbeggan were among the first to establish Ireland’s reputation for whiskey craftsmanship. Legislative milestones further shaped the industry, including a 1759 act that restricted whiskey production to grain, malt, potatoes, or sugar, and a pivotal 1785 law that taxed both malted barley and whiskey output, giving rise to pot still whiskey—a uniquely Irish style.

The 19th century marked a golden age for Irish whiskey, with over 80 operational distilleries by 1900. However, the 20th century brought challenges, including wars and Prohibition in the United States, which decimated exports. By 1980, only two distilleries remained in operation. The establishment of Cooley Distillery that same year and Pernod Ricard’s acquisition of Irish Distillers signaled a turning point. A resurgence began in the 1990s, propelling Irish whiskey to become one of the fastest-growing spirits globally. By 2023, Ireland boasted over 40 distilleries, reflecting a remarkable revival and setting the stage for continued growth in this storied industry.

A Resurgent Industry with Global Appeal

Irish whiskey has experienced extraordinary growth over the past two decades, transitioning from near obscurity to becoming one of the fastest-growing spirit categories globally. Between 2000 and 2023, the number of operational distilleries in Ireland increased tenfold—from just four to over 40. This resurgence has been fueled by Ireland’s strong economic fundamentals in the EU and US, including rising GDP per capita, growing household disposable income, and increasing demand for premium alcohol.

Spirit production in Ireland is projected to grow significantly, with production expected to increase by 35% between 2023 and 2028. And by 2028, the total market size for Irish spirits is forecast to reach EUR 1.84 billion, with Irish whiskey accounting for 57% of total production in 2023 alone. This growth underscores the product’s central role in Ireland’s Spirits sector.

The Global Whiskey Market: A Context for Growth

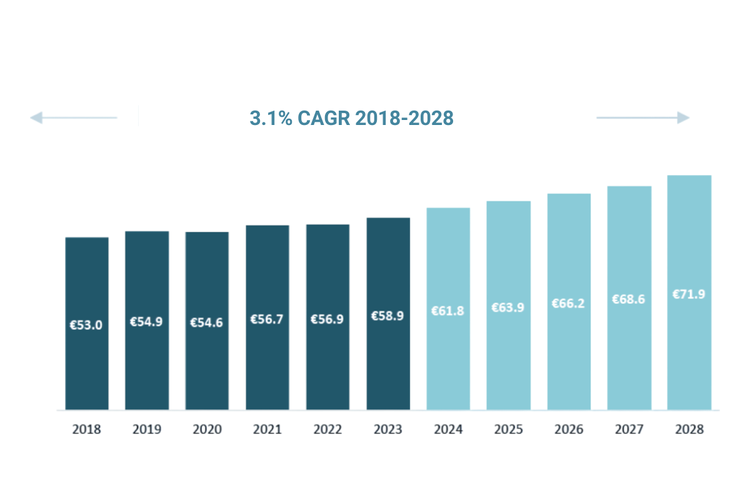

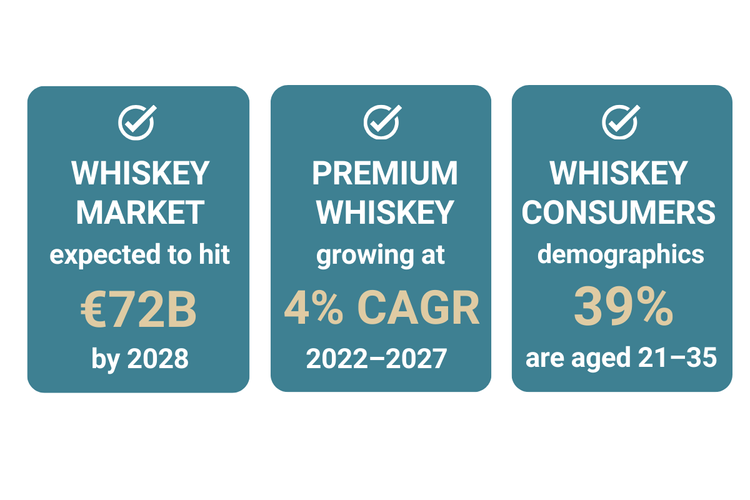

The broader global Whiskey market provides a favorable backdrop for Irish whiskey exports. Whiskey as a category has outperformed other spirits in recent years, with consumption volumes increasing by 8% in 2022 despite a 2% decline in overall global spirit consumption. The market is expected to grow at a compound annual growth rate (CAGR) of 4.1% between 2024 and 2028, reaching approximately EUR 72 billion by the end of the forecast period.

Key trends driving this growth include:

-

Premiumization: The Premium Whiskey segment is forecast to grow at a CAGR of 4% between 2022 and 2027

-

Demographic Shifts: Younger consumers are increasingly embracing whiskey; 39% of drinkers are aged between 21 and 35

-

Emerging Markets: Countries such as Nigeria, Poland and India (with a projected CAGR of 5.3% for Indian whiskey sales through 2028) represent immense opportunities for global distillery companies as demand shifts to premium brown spirits in the growing middle classes

Irish whiskey stands out within this context due to its unique distillation processes, protected status under EU laws, and its reputation as a high-quality, premium product.

Key Markets Driving Demand

The United States remains the largest consumer of Irish whiskey, accounting for over half (53%) of global consumption among the top ten markets in 2022.

Whiskey consumption in the U.S. is forecast to grow robustly over the next five years, making it a critical market for Irish producers.

Other key markets include:

-

Global Travel Retail: Sales surged by an impressive 88% in 2022

-

Poland: Consumption grew by 24% in the same year

-

South Africa: Saw a notable increase of 31%

-

Emerging Markets: Nigeria (+59%), Singapore (+55%), and South Korea (+11%) have shown strong growth potential

With exports reaching more than 120 countries, Irish whiskey producers are well-positioned to capitalize on these diverse opportunities.

Challenges and Opportunities Ahead

Despite its strong growth trajectory, the Irish Whiskey market faces challenges that require strategic navigation:

-

Market Fragmentation: While large players like Pernod Ricard (Irish Distillers), Beam Suntory (Cooley), and William Grant & Sons (Tullamore Dew) dominate, the proliferation of independent distilleries has created a more fragmented competitive landscape

-

Sustainability: As global consumers increasingly prioritize sustainability, distilleries must adopt environmentally friendly practices to maintain their appeal

-

Geopolitical Risks: Trade barriers or disruptions could impact exports to key markets including the U.S. or emerging economies. Recent imposition of tariffs by the US presents challenges but global demand should sustain growth over the medium term

However, these challenges also present opportunities:

-

Smaller distilleries can differentiate themselves through innovation or niche offerings

-

Leveraging e-commerce platforms can expand reach while minimizing distribution costs

-

Partnerships with global distillery companies can provide access to established supply chains and marketing expertise

The Road Ahead for Irish Whiskey

The medium-term outlook for Irish whiskey is undeniably positive. With global demand expected to grow by 4% year-on-year through 2024 and beyond, producers are well-positioned to capture additional market share through strategic investments and targeted marketing efforts.Premiumization remains a key driver of growth; in the U.S., premium offerings accounted for an overwhelming majority (91%) of Irish whiskey sales in 2023.

The super-premium segment is also expanding rapidly, offering high-margin opportunities for producers focused on quality over quantity.

Emerging markets present another frontier for growth. Countries including Nigeria and Singapore are witnessing rapid increases in whiskey consumption, while traditional markets such as Europe continue to provide steady demand.

For investors considering entering this space, the sector offers robust potential returns underpinned by strong consumer demand trends. Irish whiskey’s renaissance marks one of the most remarkable success stories within the global Spirits industry.

More articles

Poradce je Vaším kompasem.

Obraťte se na nás pro nezávaznou konzultaci se specialistou na fúze a akvizice, který si pozorně vyslechne Vaše potřeby a upřímně a nezaujatě posoudí nejlepší možné řešení.