Capstone Partners Reports: Environmental Health & Safety M&A Activity Increases Year-Over-Year

The Environmental Health & Safety (EHS) sector has been swiftly influenced by the recent economic headwinds from tariffs and inflation.

The US administration’s imposition of tariffs on imports from countries like China, Canada, and Mexico has raised import costs and escalation in trade protectionism is expected to increase inflation, with the fallout’s effects witnessed across a variety of EHS products.

We continue to witness strong demand for EHS companies in the M&A markets, particularly the service and consulting providers, as those companies are less impacted by global supply chain and tariff issues and continue to benefit from broader trends in outsourced services, regulatory requirements, and reshoring activity. Assuming the macroeconomic environment holds steady, EHS will continue to be a targeted sector of interest for private equity groups and industry players.

Chris Cardinale - Director, Capstone Partners - IMAP USA

More commoditized EHS products have historically been manufactured across Asia-Pacific (APAC) with substantial portions in Thailand, Malaysia, Vietnam, and China. Notably, the personal protective equipment (PPE) market was forecasted to grow 8.4% year-over-year (YOY) between 2023 and 2028 with APAC estimated to derive 36% of the growth in the forecast period, according to a report from Technavio. Public players, like Ansell (ASX:ANN) and Lakeland Industries (Nasdaq:LAKE), have discussed tariffs at length in recent calls. Ansell noted that the company will review sourcing options as a mitigator of tariffs and pass additional costs to customers.

Lakeland, however, mentioned a robust nine-to-10 months’ worth of inventory with a useful life of five years sitting in the US that are free of any tariff restrictions—a reversal of the destocking trend witnessed amid the pandemic, according to a conference transcript. This stock-up is expected to benefit Lakeland greatly as competitors struggle with rising costs and customer contract adjustments.

Private Equity Buyers See Reinvigorated Acquisition Appetite

The transition by corporations to bring manufacturing stateside has created greater demand for EHS products and services has created tailwinds for M&A activity as companies seek to mitigate supply chain risks and capitalize on government incentives.

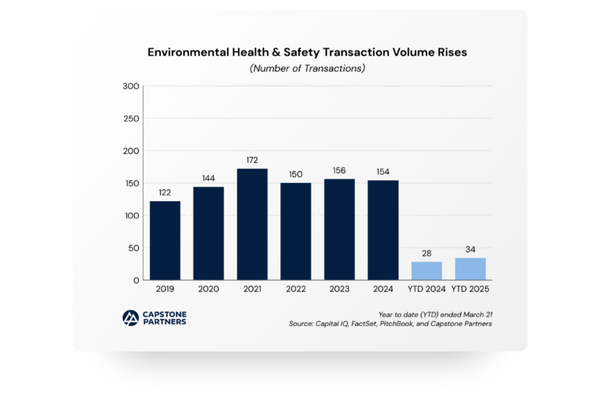

M&A volume in the EHS sector has risen year to date (YTD) with 34 deals announced or completed compared to 28 in the prior year period.

Private strategics have retaken the lion’s share of M&A activity, comprising 35.3% of deal activity YTD, doubling deal volume from the prior year period. Public strategics have seen activity soften, falling to five deals through YTD compared to nine in the prior year period.

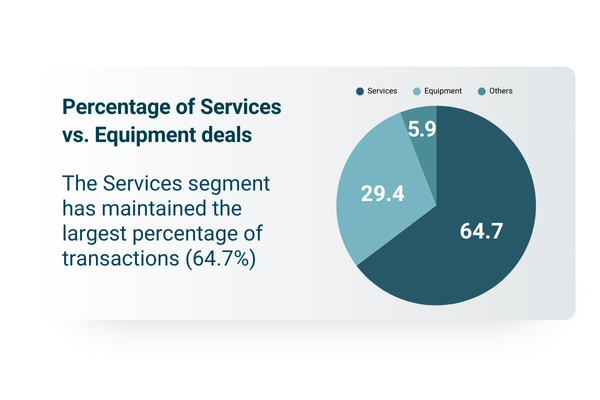

Capstone expects the Equipment segment (29.4% of total deals to date) to hold steady, while the Services segment has maintained the largest percentage of transactions (64.7%), as sector participants require assistance in adjusting to the new administration’s regulation changes.

Private equity buyers have recognized the subsequent transition brought on by proposed tariffs and have entered the market in force, aligning themselves with broader national strategies for critical health and safety equipment and services.

Add-on acquisitions have risen from nine deals announced or closed in YTD 2024 to 12 deals through YTD 2025. Platform acquisitions have witnessed a similar increase rising from four deals to six deals to date. Notably, Wynnchurch Capital-backed ORS Nasco, a distributor of industrial supplies in North America and internationally, acquired Ohio-based R3 Safety, a redistribution company of industrial products and PPE for an undisclosed sum (February). ORS Nasco acquired R3 safety from U.K.-based Bunzl (LSE:BNZL), demonstrating the broader trend of supply chain domestication.

M&A Pricing Remains Strong Amid Market Volatility

Defensible gross margins and a high degree of revenue visibility have backed robust M&A pricing in the EHS sector. M&A transaction multiples in the space have averaged 2.0x EV/Revenue and 11.6x EV/EBITDA from 2018 through YTD 2025, outperforming public strategics in Capstone’s EHS index on both a revenue and EBITDA basis. The elevated M&A valuation average can be attributed to premiums placed on product diversification, geographic prevalence in the US, and competitive markets. Capstone expects deal activity to continue to outpace prior year volume through year-end as private strategics have returned to the market in force and financial buyers continue acquiring businesses with recurring revenues and growth visibility. The current valuation environment continues to fare well for prospective sellers as competition among buyers remains stiff.

The above is an excerpt from Capstone Partners’ Environmental Health & Safety Report. For over 20 years, Capstone Partners - IMAP USA has been a trusted advisor to leading middle market companies, offering a fully integrated range of investment banking and financial advisory services uniquely tailored to help owners, investors, and creditors through each stage of the company's lifecycle.

More articles

Poradce je Vaším kompasem.

Obraťte se na nás pro nezávaznou konzultaci se specialistou na fúze a akvizice, který si pozorně vyslechne Vaše potřeby a upřímně a nezaujatě posoudí nejlepší možné řešení.