Capstone Partners - IMAP USA Reports on M&A Activity in the Packaging Industry as Players Divest Non-Core Assets

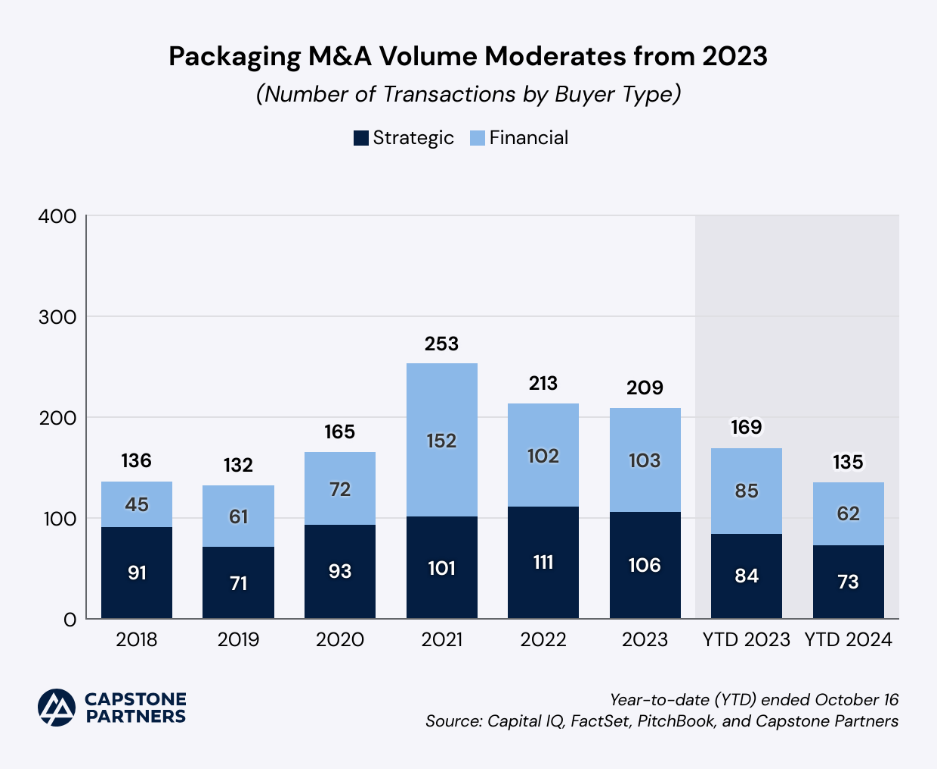

Packaging M&A activity has moderated with 135 deals announced or completed year to date (YTD)—a 20.1% decrease from the prior year period. A large portion of the initial transaction inventory in 2024 has been fueled by the realignment of portfolio businesses. The shedding of non-core assets that no longer fit strategic visions has allowed sector players to channel resources toward high-growth areas. Public strategic buyers have prioritized transacting with one another and deploying capital inflows, seen by its increased share of deals year-over-year (YOY).

In contrast, sponsor acquisitions have fallen 26.3% to date and private strategic activity slowed 18%. The disclosed enterprise value of sector acquisitions YTD has totaled $18.5 billion, demonstrating a resilient appetite for middle market participants in conjunction with an influx of megadeals. M&A multiples in the Packaging sector have remained healthy, averaging 1.5x EV/Revenue and 8.7x EV/EBITDA from 2021 through YTD. Public companies have also traded at strong multiples, which may buoy M&A valuations in the long-term. Major Packaging sector players have reevaluated portfolios in order to streamline operations and focus on core competencies. This shift has been driven by a desire to enhance profitability and align with sustainable growth trends as companies increasingly prioritize environmentally-friendly solutions and digital innovations.

“Now that we are past most of the impacts from the pandemic, and the experienced spike in demand for packaging products related to e-commerce activity, the sector has normalized with less destocking activity and pricing stabilization within the commodity input markets. This has led to more confidence from the buyer community when analyzing potential targets for factors such as recent company performance, margin sustainability, and go-forward predictability of revenue and profitability. This confidence, coupled with continued innovation in packaging sustainability and an anticipated increase in overall M&A activity going forward, will lead to strength in packaging M&A and robust interest from private equity groups and strategic buyers."

Mike Schumacher

Managing Director, Capstone Partners (IMAP USA)

Sustainability Standards Persist, Reshoring Trends Take Shape

Extended producer responsibility (EPR) in the Packaging sector has become an increasingly important component of sustainability initiatives worldwide. Stakeholders have determined that producers have a responsibility for the treatment and disposal of post-consumer products, and the U.S. government has intended to enforce regulations. In September, California Attorney General, Rob Bonta, filed a lawsuit against ExxonMobil (NYSE:XOM) for exacerbating global pollution by running a “decades-long campaign of deception” that dramatically overstated the efficacy of plastic recycling, according to a press release. Manufacturers in the Packaging market have toggled back and forth with the expectation of managing the end-of-life impact of packaging materials they produce. This has often involved funding recycling programs, redesigning packaging for greater recyclability, or reducing the amount of packaging used, among other initiatives, with the aim of minimizing what ends up in landfills and as harmful pollution.

The Packaging sector has seen a surge in megadeals (more than $5 billion in enterprise value) to-date as sector players have turned to consolidation to gain a competitive advantage and bolster sustainability efforts. One of the most significant moves was Smurfit Kappa’s September 2023 merger with WestRock ($21 billion, 1.0x EV/Revenue, 6.3x EV/EBITDA), a deal that has now been approved and closed as of July 2024. The merger has created one of the largest packaging companies globally, giving the new entity, Smurfit WestRock (NYSE:SW), more influence in shaping the future of sustainable packaging. The company is expected to leverage their combined resources to innovate in EPR initiatives, pushing forward developments in circular economy practices and sustainable packaging solutions. The deal further highlights the growing trend of consolidation in the Packaging market, as larger players seek to capture market share and meet regulatory pressures around environmental responsibility.

Packaging players have also begun adapting production strategies in response to changing trade policies and tariffs. Canada has aligned its tariff structures with the U.S. for certain goods, and companies have gradually looked toward Mexico as an alternative country for production Trade agreements including the U.S.-Mexico-Canada Agreement (USMCA) provide a favorable option for North American production while avoiding trade disruptions and geopolitics stemming from overseas manufacturing. Of note, Mauser Packaging Solutions’ subsidiary, BWAY, acquired Mexico-based Taenza, a manufacturer of tin-steel general line, sanitary, aerosol cans, and steel pails for an undisclosed sum (May). Mauser simultaneously shuttered its Aerosol Can business in Cincinnati, Ohio and Sturtevant, Wisconsin, citing “ongoing economic difficulties” as the reason for the closure, according to an article from Spray Technology & Marketing. Similar shifts in the Packaging market may facilitate more production facilities being moved to or expanded in Mexico, where companies can still cater to the U.S. and Canadian markets while enjoying more favorable cost structures and avoiding disruptive tariff and trade policy impacts.

The above is an excerpt from Capstone Partners’ November 2024 Packaging M&A Update Report. For more than 20 years, Capstone Partners has been a trusted advisor to leading middle market companies, offering a fully integrated range of investment banking and financial advisory services uniquely tailored to help owners, investors, and creditors through each stage of the company's lifecycle. Capstone Partners is IMAP's partner in the USA. To learn more, visit www.capstonepartners.com.

Key contacts

More articles

Poradce je Vaším kompasem.

Obraťte se na nás pro nezávaznou konzultaci se specialistou na fúze a akvizice, který si pozorně vyslechne Vaše potřeby a upřímně a nezaujatě posoudí nejlepší možné řešení.