India's Packaging Industry: A Billion-Dollar Transformation Beckons

India's Packaging industry is on track to outperform the global market significantly. While the global Packaging market is forecasted to grow from USD 1,140 billion in 2024 to USD 1,380 billion by 2029, according to data from Mordor Intelligence, India's industry is set to expand at a faster pace.

Recent research projects it will grow from USD 84 billion in 2024 to USD 143 billion by 2029, achieving an impressive compound annual growth rate (CAGR) of 11%, underscoring India's rising prominence and leadership in the industry. This robust expansion is positioning India to capture an increasing share of the global Packaging market, with its share projected to grow by approximately 10.5% by 2029.

The Asia-Pacific region, which includes India, already dominates the global market with a 39% share, followed by North America at 28% and Europe at 26%.

Market Dynamics: A Nuanced Picture

The sector's growth in India paints a complex picture of economic opportunity. Flexible Packaging, commanding a dominant 65% market share, is anticipated to surge from USD55 billion to USD 94 billion by 2029. This segment's rapid ascent is driven by a confluence of factors, including sustainability trends and technological advancements. Meanwhile, Rigid Packaging, though smaller in market share, promises equally robust growth, projected to expand from USD 29 billion to USD 51 billion in the same period.

India's Edge

India's competitive advantages in the packaging sector are stark and multifaceted:

-

Cost-effectiveness: Manufacturers in India can achieve up to 40% savings compared to their European counterparts, a significant edge underpinned by low food processing costs and a skilled workforce

-

Untapped Potential: The country's plastic consumption stands at a mere 15 kg per person annually, signaling vast untapped potential when compared to global peers. This low baseline suggests significant room for growth as consumer habits evolve and the economy expands

-

Government Support: Initiatives like "Make in India" and GST reforms are bolstering the demand for advanced packaging infrastructure, creating a more conducive environment for both domestic and international players.

Strategic Inflection Points

Several key drivers are shaping the future of India's Packaging industry:

-

E-commerce Expansion: India's e-commerce market is poised to become the third largest sector in the country by 2030, driving demand for diverse and innovative packaging solutions

-

Rising Middle-class Consumption: The expanding middle class, with increasing disposable incomes, is fueling demand for packaged goods and premium experiences. Prioritizing convenience and longer shelf-life in food and beverage products

-

Sustainability Imperatives: Companies are increasingly investing in recyclable, reusable, biodegradable and even, edible materials, responding to both regulatory pressures and consumer preferences

-

Technological Innovation: The adoption of smart packaging technologies, including RFID, NFC, and QR codes, is enhancing product authentication and supply chain efficiency

Market Segmentation and Trends

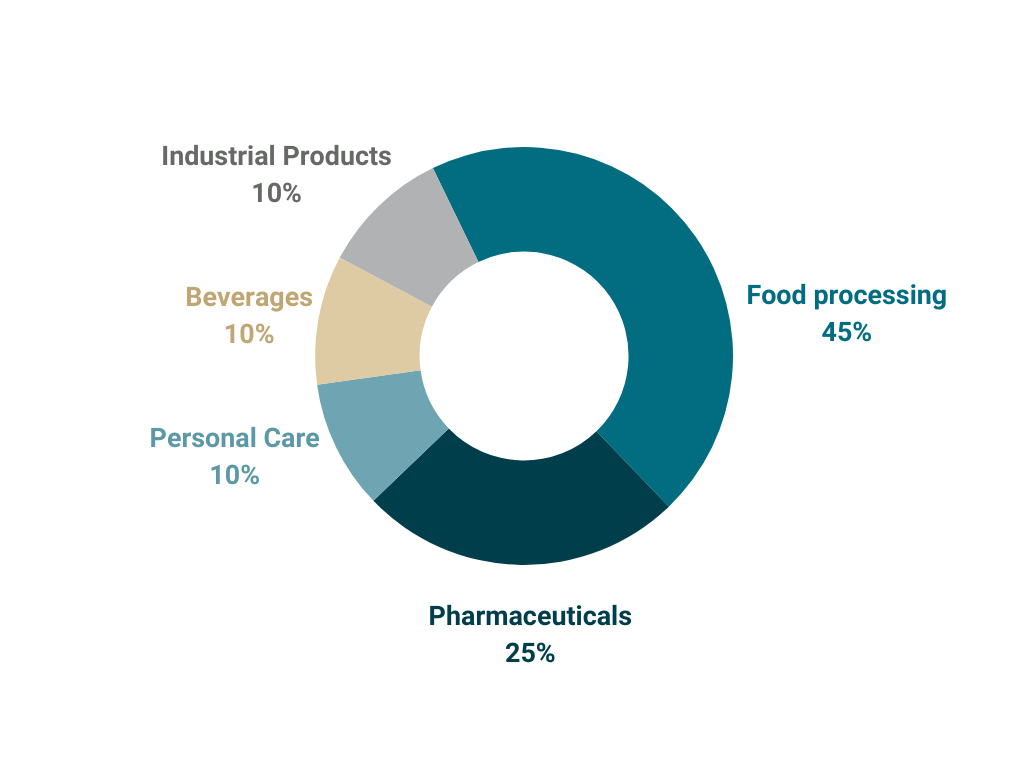

The industry caters to various end-user categories, each with its unique dynamics:

-

Food Processing: Leading with a 45% market share, this segment is driven by the rise of food delivery services and changing lifestyle patterns. Key players include Tetrapak International, Essel Propack, and Pearl Polymers

-

Pharmaceuticals: Accounting for 25% of the market, this sector is seeing increased adoption of innovative packaging materials for better protection and convenience. Key players include West Pharmaceutical Services, SDG Pharma, and Huhtamaki

-

Personal Care: Accounting for 10% of the market, this sector is experiencing an increase in demand for convenience products and premiumization with customers willing to pay more for higher-quality products. Key players include Ball Corporation, Bemis, and Amcor

-

Beverages: Accounting for 10% of the market, this sector is also experiencing an increase in single-serve and on-the-go packaging and increased demand for high-end packaging. Key players are ELP, TCPL Packaging, and Uflex

-

Industrial Products: Comprising 10% of the market, is being transformed by smart packaging enhancing supply chain efficiency. Key players include: Balmer Lawrie & Company, Mold Tech Packaging, and Parekhplast

Opportunities for Investors

The Indian Packaging sector offers compelling opportunities for investors, with 100% foreign direct investment allowed through automatic route. Global players such as SIG are already investing in India, demonstrating international confidence. The sector's attractiveness is enhanced by the availability of raw materials, with domestic companies like Garware Hi-Tech and Uflex making strides in backward integration. Sustainability has become a crucial focus, driven by regulatory measures and consumer preferences. Several states have banned single-use plastics, prompting companies like ITC and Nestlé to commit to reusable or recyclable packaging. This shift towards sustainable alternatives not only addresses environmental concerns but also offers economic benefits for businesses in the sector.

Indian Packaging: A Catalyst for Global Manufacturing Transformation

The Indian Packaging sector represents more than just an industrial segment – it is a microcosm of India's economic ambition and its potential to redefine global manufacturing dynamics. As the industry continues to grow and innovate, it offers both domestic and international opportunities for growth, investment, and technological advancement. The coming years promise to be transformative for India's packaging landscape, with ripple effects likely to be felt across the global market.

More articles

Poradce je Vaším kompasem.

Obraťte se na nás pro nezávaznou konzultaci se specialistou na fúze a akvizice, který si pozorně vyslechne Vaše potřeby a upřímně a nezaujatě posoudí nejlepší možné řešení.