How to Use Equity Acceleration Plans to Maximize Business Value

Savvy business owners are increasingly turning to Equity Acceleration Plans (EAP) as a strategic tool to enhance company valuations. While conventional wisdom often emphasizes profit growth, an EAP shifts the focus to a critical, yet often overlooked component of business valuation: the Multiple.

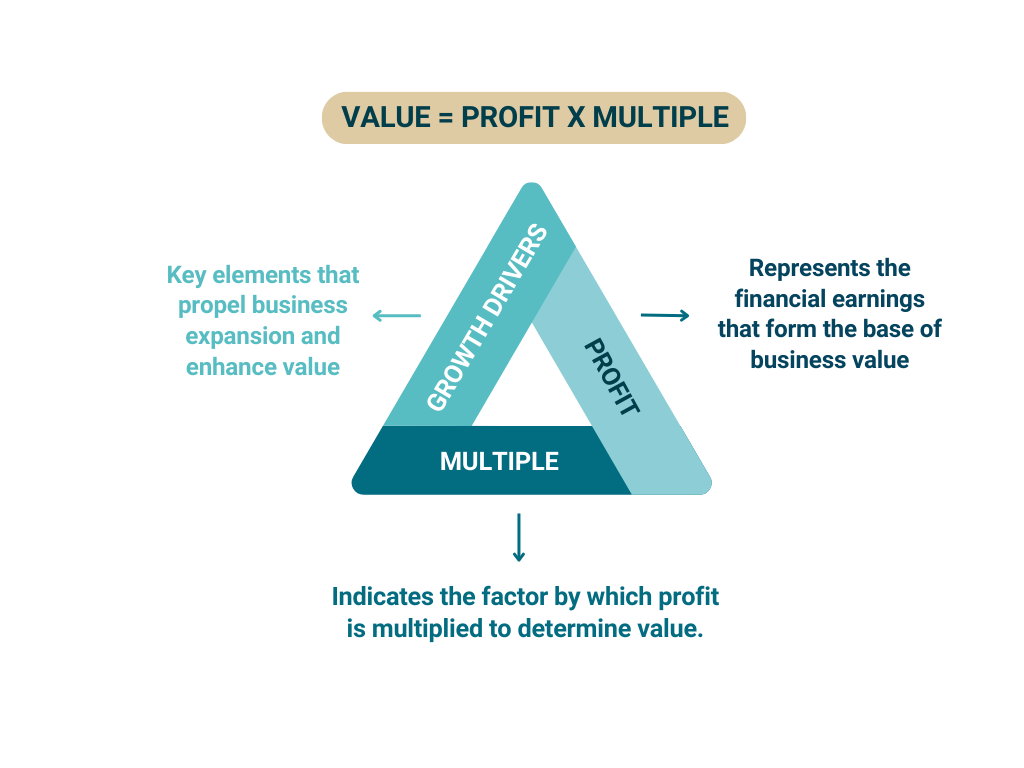

At its core, business valuation adheres to a straightforward equation: Value equals Profit times by the Multiple. Using an EAP, a more innovative approach, concentrates on elevating the Multiple, potentially yielding more substantial increases in overall business value than what can be achieved through profit growth alone.

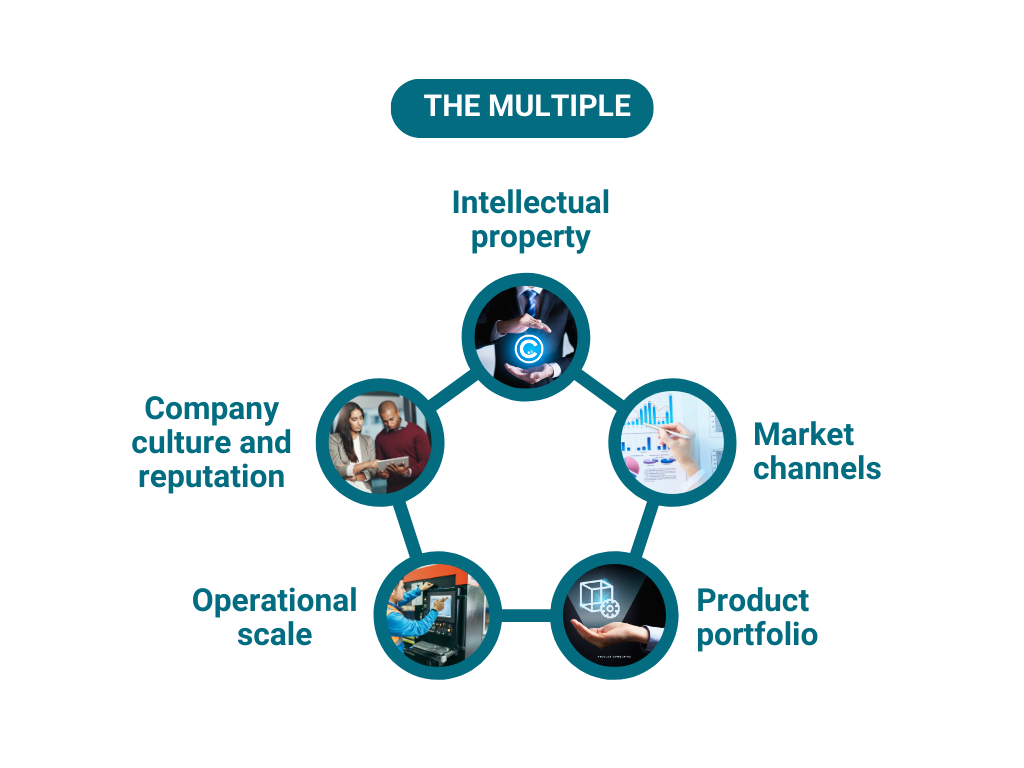

The Multiple is a dynamic reflection of a company's perceived value. It encompasses both tangible and intangible assets, including company culture, brand reputation, market channels, intellectual property, product portfolio, and operational scale.

IMAP’s EAP methodology is designed to maximize these value drivers while simultaneously mitigating risks that could potentially erode the Multiple.

Based on research over many years and from delivering hundreds of transactions, our methodology allocates a weighting of importance to each risk factor and growth accelerator.

Mapping your business as it currently stands against these criteria, paints a clear picture of where you need to focus to drive equity value and to ensure you maximise both the probability of a successful sale and the price you receive.

This comprehensive strategy involves a meticulous process of assessment, identification of improvement areas, strategy development, implementation, and ongoing monitoring. Key focus areas include the strength of the management team, market positioning, growth potential, financial performance, operational efficiency, and the robustness of the customer base.

The efficacy of an EAP is perhaps best illustrated through real-world applications. In one notable instance, a healthcare company founded in 2006 initially received an offer at 7.5 times EBITDA. Following the implementation of the EAP recommendations over a 12-month period, which included strategies for US market entry, internationalization, and product development, the company ultimately sold for 10 times EBITDA – representing a remarkable 2.5x increase from the original offer.

For business owners contemplating the implementation of an EAP, the journey begins with contacting specialized advisors (such as our teams at IMAP). These professionals conduct an in-depth analysis of the business, usually over a 6–8-week period, culminating in strategic recommendations aligned with the company's specific circumstances and objectives.

While an EAP is particularly valuable for businesses preparing for a sale, its principles offer benefits across various stages of a company's growth trajectory.

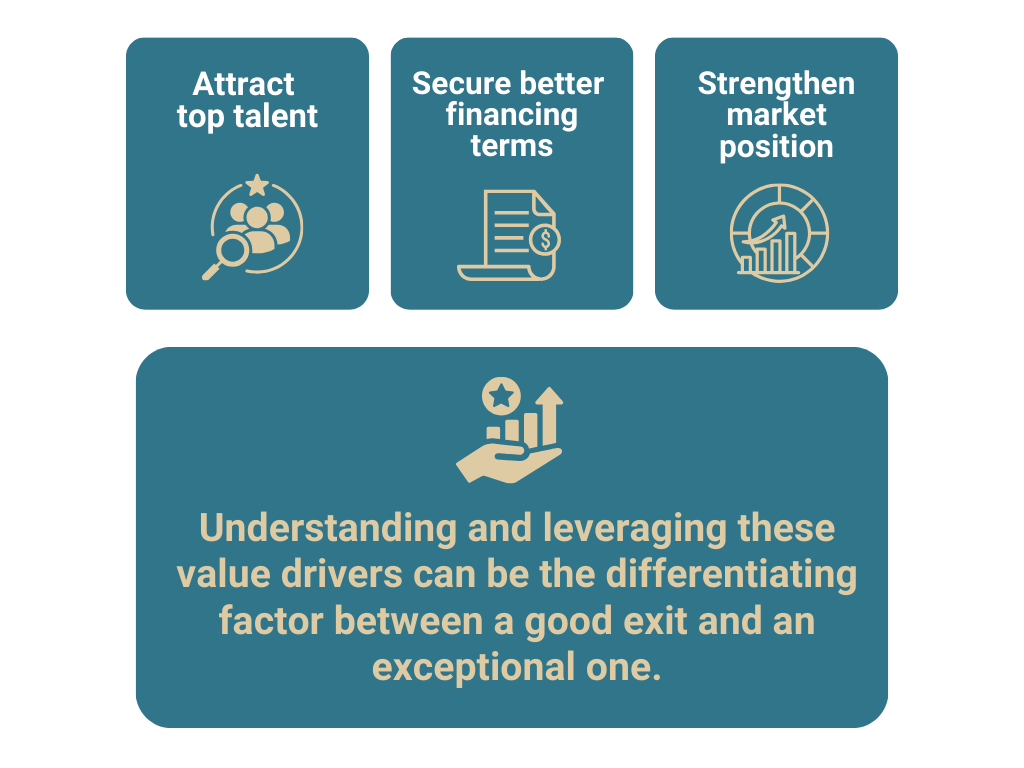

By focusing on key value drivers, businesses can enhance their ability to attract top-tier talent, secure favorable financing terms, streamline operational efficiency, and bolster their market position.

An Equity Acceleration Plan represents a holistic, strategic approach to increasing business value. By shifting the focus from profit alone to enhancing the Multiple, an EAP can catalyze significant increases in overall company worth.

Understanding and leveraging these value drivers can be the differentiating factor between a good exit and an exceptional one.

By addressing both growth accelerators and potential risks, companies can position themselves more advantageously in the market, ensuring long-term success and maximizing value in future transactions.

Key contacts

More articles

Poradce je Vaším kompasem.

Obraťte se na nás pro nezávaznou konzultaci se specialistou na fúze a akvizice, který si pozorně vyslechne Vaše potřeby a upřímně a nezaujatě posoudí nejlepší možné řešení.