TMT, Industrials, and Healthcare Dominating the M&A Market in Switzerland

Beat Unternaehrer, Chairman of The Corporate Finance Group (TCFG) explains why Switzerland remains an attractive option for investors, examines the local economy and outlines the top six factors driving a healthy level of M&A activity.

Founded on Experience and Reach

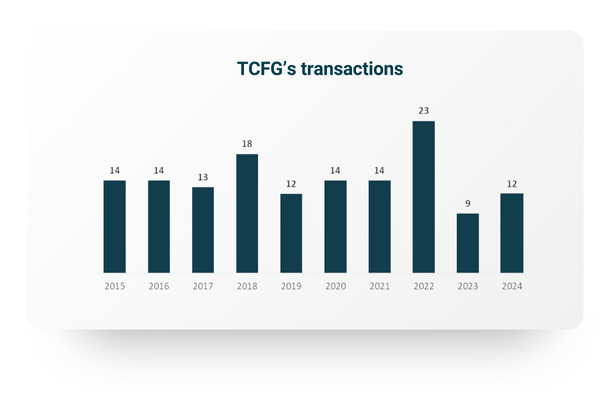

Founded in 2000, by five experienced M&A advisors, TCFG is the leading independent mid-market M&A and Corporate Finance firm in Switzerland. With offices in Zurich, Berne, Geneva and Lugano, we are the only M&A consulting firm physically present in the German, French, and Italian speaking regions of Switzerland. TCFG has advised on an average of 15-20 transactions per year since our foundation.

Excellence in M&A

TCFG is known for excellence in mergers & acquisitions, corporate finance, and restructuring, and since its founding our team has advised on more than 300 disclosed transactions and 500 projects. We are also accredited by the Swiss Takeover board to provide fairness opinions in connection with public transactions. Around 30% of our transactions are cross-border.

Some of the transactions we advise on are:

-

Entrepreneurial Successions

-

Sell-Side Advisory

-

Buy-Side Advisory

-

Management Buy Out & Buy In

-

Mergers

Our Team

TCFG partners perceive themselves as coaches, sparring partners, and general contractors for the process. Each of our six partners have more than 15 years of experience in project leadership and handling of complex mergers and acquisitions process management. Our diverse backgrounds and strong team of consultants and advisors enable us to manage interdisciplinary task force teams (due diligence specialists, lawyers, tax experts etc.) highly effectively, ensuring transactions are successful and efficient.

Switzerland Economic Snapshot

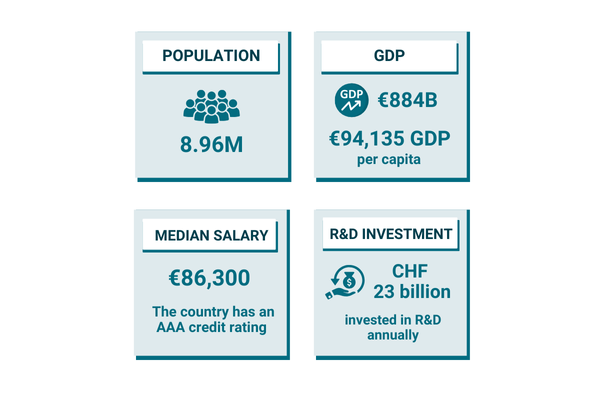

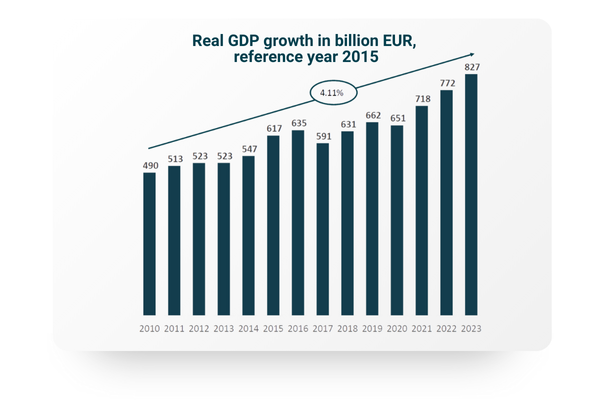

Switzerland has a population of 8.96 million (2023). With a nominal GDP of EUR 884 billion (7th highest in Europe) and a GDP per capita of EUR 94,135 (3rd highest in Europe), the country has an AAA credit rating. In terms of employment, Switzerland has one of the lowest unemployment rates at 2.4% and the median salary is EUR 86,300. The Swiss federation expects the population to grow to approximately 10.44 million by 2050, which will further fuel GDP growth.

As of July 2024, the annual inflation rate stood at 1.3% in Switzerland and the Swiss National Bank expects inflation to further decline to between 0.50% and 0.75%. As a result, the Swiss National Bank cut interest rates from 1.25% to 1.0% in September 2024 and announced the likelihood of further interest rate cuts which will likely fuel GDP growth.

While global players from varying industries are headquartered in Switzerland (Novartis, UBS, Nestle, Swissport, ABB, etc) SMEs employing fewer than 250 staff are the lifeblood of the Swiss economy. They account for 99% of all businesses and provide roughly two-thirds of the jobs in Switzerland. Many of them are family run.

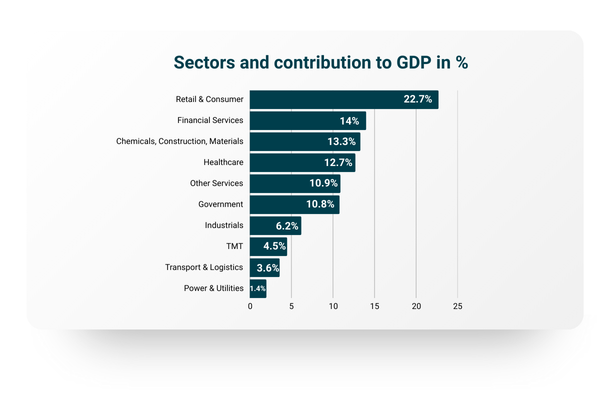

Approximately 74% of Swiss GDP is generated by the Services sector, while the remainder comes from various sectors including Industrials, Manufacturing, and Materials. The EU is Switzerland's main trading partner with around 67% of Swiss imports coming from the EU, while 50% of Swiss exports are to EU countries.

Switzerland has maintained a low level of public debt relative to other countries even during the COVID-19 crisis. At the start of 2021, gross government debt (before deduction of financial assets) stood at approximately CHF 100 billion, representing 15% of GDP.

The country invests approximately CHF 23 billion annually in research and development (R&D), representing around 3% of its GDP. The private sector plays a significant role, contributing over two-thirds of this total expenditure.

Snapshot of the Swiss M&A Landscape

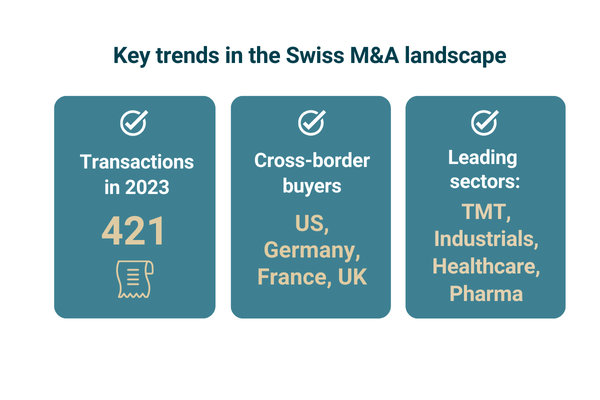

Switzerland has a well-established and resilient M&A market which continues to see solid deal flow for succession of small and medium-sized businesses. Synergies and cost savings tend to be the driving force of many transactions, while operations aiming to promote growth and innovation are expected to increase along with sales and spin-offs of non-core businesses.

In terms of industry, we see a focus on Technology, Media and Telecom, Industrials, Pharma, and Healthcare. Between 2015-2022 the total number of transactions increased from 216 to 483 respectively, and in 2023, 421 transactions were recorded while the number of transactions as of September 2024 sat at 216.

In terms of cross-border deals, US companies are the most active buyers of Swiss targets, followed by companies in Germany, France and the UK. Whereas Swiss companies have purchased more companies in Germany followed by the US, UK, and Italy.

Current Economic Drivers and Opportunities

We have identified six key areas which are driving the Swiss economy and therefore, opportunities for cross-border investment:

- Family businesses preparing for succession

- Fragmented markets with opportunity for private equity led roll-up strategies

- Top research universities and innovative companies in AI, drones, robotics, biotech, and other technology areas

- Strong trade agreements with major economies and excellent external relations

- Appreciation of the Swiss Franc against the EUR and other major currencies has made it a desired assets for foreign investors

- A liberal stance on Foreign Direct Investment, facilitating cross-border inflows and M&A activity

A Proven Track Record in M&A

TCFG is the leading independent mid-market advisor in Switzerland and number four in the country by number of deals closed. Our most recent transactions include:

-

Industrials: Wesco’s sale to Franke (acting for the seller)

-

Energy & Utilities: AEW’s sale of a 27.3% participation in Fernwärme Siggenthal to Regionalwerke AG Baden (acting for the seller)

-

IT, Media & Telecoms: Moneyland.ch’s sale to Swiss Market Place Group (acting for the seller)

-

In Other Services: Wenger Betriebe’s sale to Bethesda (acting for the seller) and Avenir Group’s sale to Liberta Partners (acting for the seller)

In 2025, while existing uncertainties are still a concern, global economic growth will remain solid, and inflation will fall, so we expect the recovery of the M&A market to continue. We have a strong pipeline and new transaction announcements are already on the horizon.

In contrast to the USA, valuations in Switzerland are at a reasonable level, which means that more North American buyers could also come onto the scene here. We expect a solid deal flow for smaller and medium-sized transactions, particularly in our strategic focus area of succession planning.

Strategically sensible additions through M&A transactions will remain very popular, while purely financially motivated transactions will have a hard time. We will also continue to see sales and spin-offs of parts of companies that are not part of the core business.

The search for growth and innovation will remain a driver of M&A transactions in 2025. The conditions for successful M&A transactions are therefore in place despite the continued uncertain environment.

Key contacts

More articles

Poradce je Vaším kompasem.

Obraťte se na nás pro nezávaznou konzultaci se specialistou na fúze a akvizice, který si pozorně vyslechne Vaše potřeby a upřímně a nezaujatě posoudí nejlepší možné řešení.