Software Sector Shows Resilience Amid Market Fluctuation

The Software industry continues to demonstrate its resilience and attractiveness to investors, as revealed in IMAP Germany’s Q3 2024 “Software Sector Report". The report highlights sustained high levels of M&A activity in the DACH region (Germany, Austria, and Switzerland), with Private Equity (PE) firms playing a pivotal role in shaping the landscape.

Technology Assets Increasingly Attractive to Investors

In the first half of 2024, the DACH region witnessed 19 deals across various software subsectors, including horizontal, vertical, and infrastructure software. This activity is part of a broader trend, with the report analyzing 200 investments in software companies since 2014. The lower mid-market has been particularly active, with specialized investors pursuing aggressive buy-and-build strategies for their platforms.

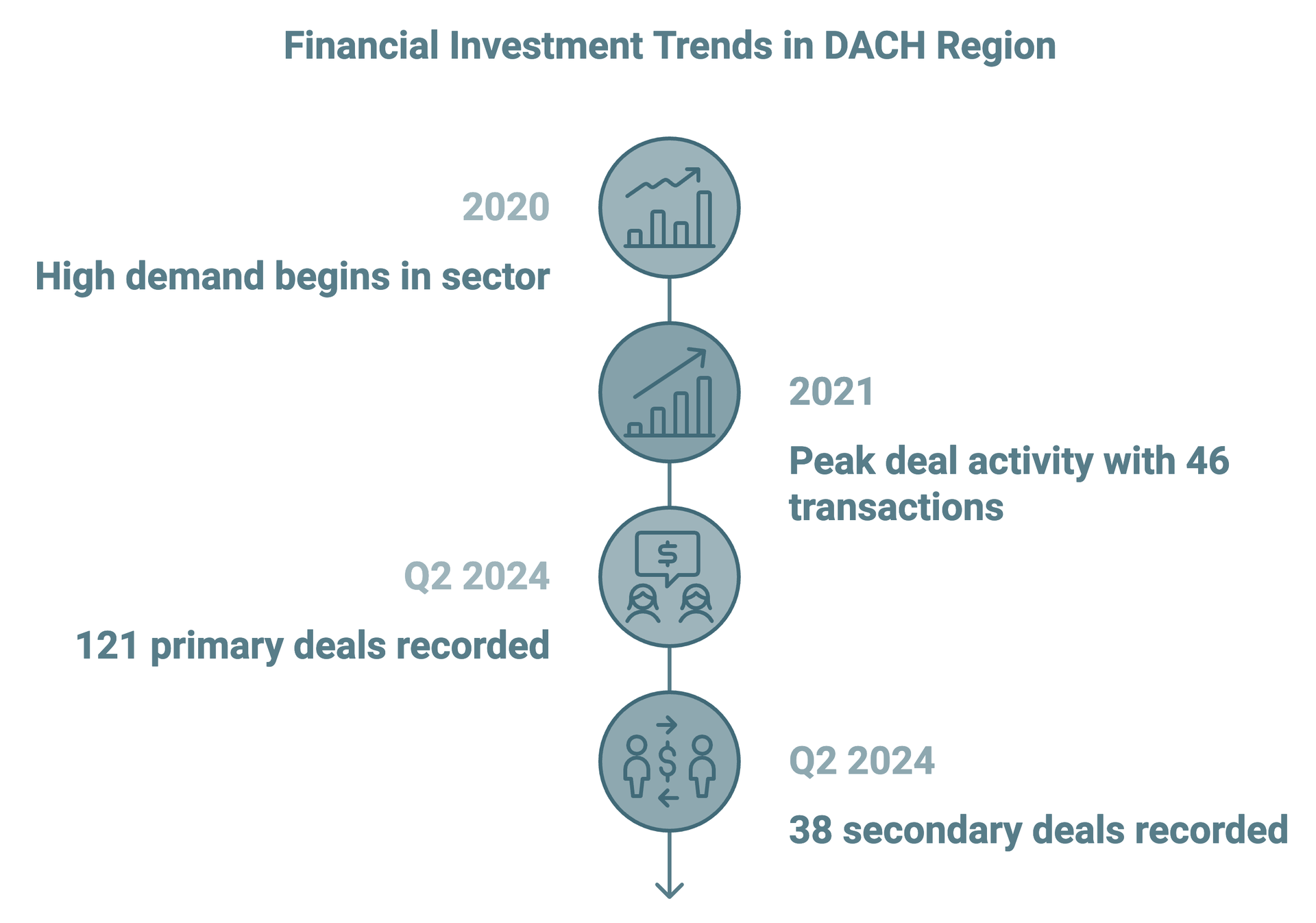

The report identifies 83 financial investors with current investments in 198 software companies across the DACH region. Since 2020, the sector has experienced high demand, with 159 transactions recorded. The year 2021 marked a peak in deal activity, boasting 46 transactions. Notably, between 2020 and the end of Q2 2024, 121 deals were primary (Entrepreneur to PE), while only 38 were secondary (PE to PE).

The increasing focus on technology assets is evident, with 16% of investors acquiring more than three software companies.

Specialized funds in the lower mid-market, such as Elvaston, Main Capital, Yttrium, Bregal, and Battery, have built substantial portfolios. Approximately 22% of the analyzed platforms generate annual revenues exceeding €50 million, with 10% surpassing the €100 million mark. In terms of employment, about 24% of the platforms employ more than 250 people, and roughly 5% have over 1,000 employees.

Performance Across the Divisions

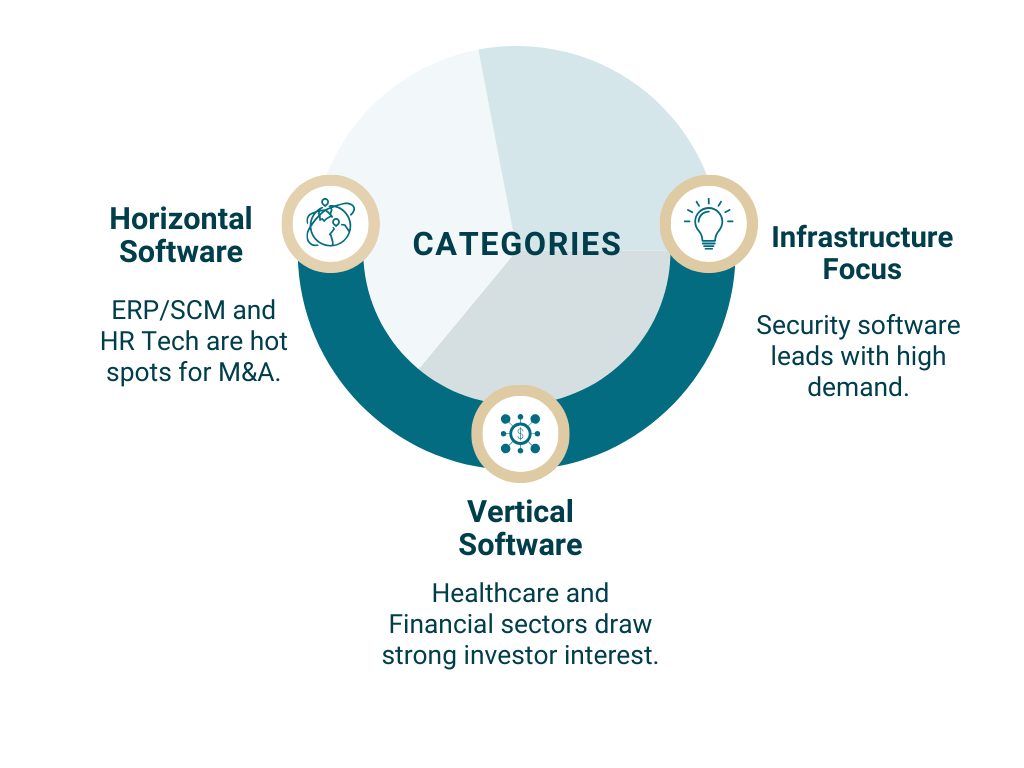

The Software market can be divided into horizontal, vertical, and infrastructure categories:

-

Horizontal software, particularly in the ERP/SCM space and HR Tech sub-sector, has seen high M&A activity

-

Vertical software, especially in the Healthcare and Financial sectors, has also attracted significant investor interest

-

In the Infrastructure market, security software dominates

Stock Prices & Valuation Multiples

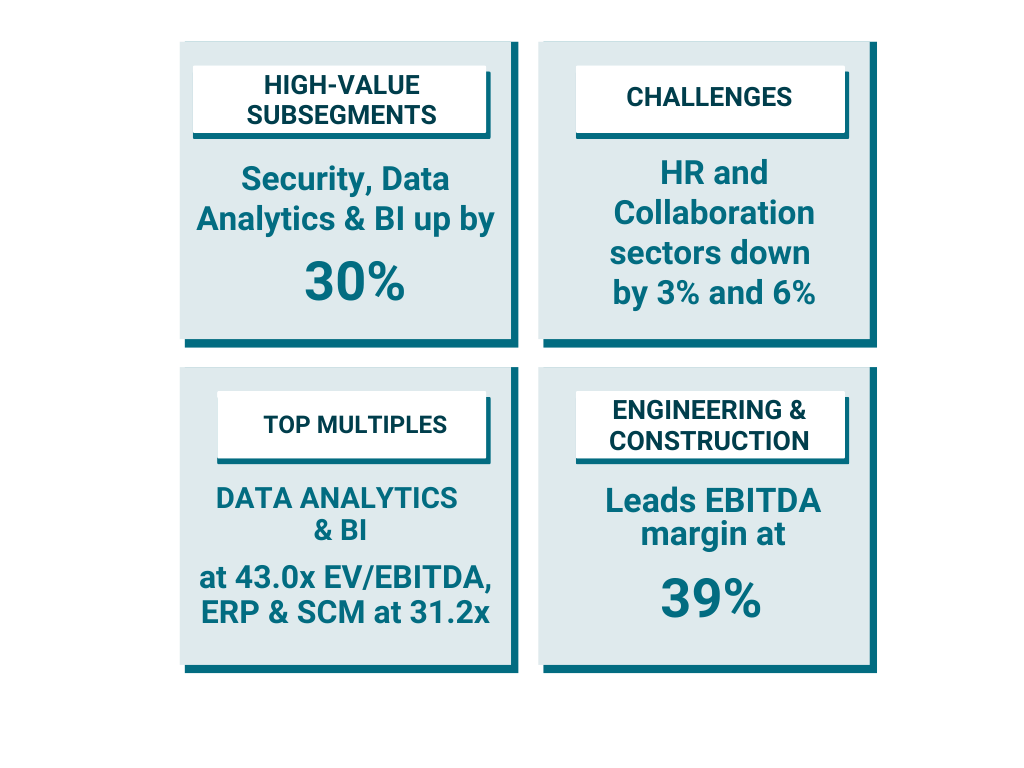

Public markets have shown a mixed performance for software companies. As of June 2024, the last twelve months' stock performance exhibited heterogeneous development across different subsectors. Security and Data Analytics & BI companies saw stock price increases of over 30%, while HR and Communication & Collaboration sectors experienced declines of 3% and 6%, respectively.

Meanwhile, valuation multiples remain robust:

-

Engineering & Construction are trading at the highest EV/Revenue multiple of 10.7x in Q1 & 2 2024

-

Sales & Marketing continues to lead in expected revenue growth for 2024, projecting 14% growth, followed closely by Data Analytics & BI at 13%

-

Data Analytics & BI commands the highest EV/EBITDA multiple at 43.0x, with ERP & SCM following at 31.2x.

-

Engineering & Construction boasts the highest EBITDA margin at 36%

The Rule of 40

A notable shift in focus is expected among SaaS companies between 2023 and 2025, moving from "pure" growth to profitable growth, as indicated by the Rule of 40 (a method for valuing software companies which measures the trade-off between growth and profitability).

Notable Transactions in the German and European Software Market

TPG acquired a majority share in Aareon for €3.9 billion, while Deutsche Börse Group took a majority stake in SimCorp for €4.0 billion. Silverlake's acquisition of a majority share in Softwareone for €2.3 billion further underscores the sector's attractiveness to large investors.

As the Software industry continues to evolve, it remains a key focus for investors, driven by digital transformation trends and the increasing importance of technology across all sectors. And despite market fluctuations, the software sector's fundamentals remain strong, with ample opportunities for both strategic and financial investors in the coming years.

IMAP Germany has a strong track record in the Technology sector. Since 2015 the team has completed 280+ deals in the technology space, averaging 28 transactions per year. More than 30% of these deals were cross-border, with over 60% involving European targets. More recently in the Software Sector, IMAP Germany has advised founders of ARWINET/KubeOps on the sale to Bechtle, has advised the shareholders of OMNEVO on the sale to Ventiga, and has advised the shareholders of SEP on the sale to BIP Group.

To read the full IMAP Germany Q3 Software Report, click here.