IMAP Expands Foothold in GCC with new Partner Alpen Capital

IMAP welcomes Alpen Capital as its corporate finance partner for M&A activities in the Gulf Cooperation Council (GCC), further expanding its geographical diversity. Sameena Ahmad and Krishna Dhanak, both Managing Directors at Alpen Capital explain why the region and its robust M&A market are so attractive to investors and which sectors are expected to pose the greatest opportunities for transactions moving forward.

SAMEENA AHMAD

Managing Director

Alpen Capital – IMAP GCC

sameena.ahmad@imap.com

KRISHNA DHANAK

Managing Director

Alpen Capital – IMAP GCC

krishna.dhanak@imap.com

Providing Sound Solutions Since 2005

Alpen Capital is an investment banking advisory firm specializing in providing customized solutions in the areas of debt, M&A, and equity to institutional and corporate clients. With deep local know-how and regional expertise, we have executed transactions for leading business conglomerates and financial institutions across the GCC, South Asia, Levant, and Africa. We have offices in Dubai, Abu Dhabi, Doha, Muscat, and India and an operational footprint in over 30 countries.

Our vast network of international investors and funders gives us the ability to structure unique and innovative solutions for companies who are looking to grow the long-term value of their business. Our clients are based across various sectors such as Retail, Healthcare, Insurance, Hospitality, Education, Food, and Technology

We are committed to partnering with companies that focus on Environmental Social Governance (ESG) and support in achieving Sustainable Development Goals (SDGs) outlined by the United Nations. We have completed more than 30 transactions with Development Financial Institutions and Impact Investing Funds that have aided financial inclusion, women empowerment and agribusiness in emerging markets and supported at least nine different SDGs.

GCC – A Preferred Investment Destination

The GCC countries, comprising Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates (UAE), have emerged as a significant force in the global economy. With their strategic location, abundant natural resources, and a growing population, these countries have experienced rapid economic development and have become key players in sectors such as Energy, Finance, Real Estate, and Tourism. The GCC countries offer a unique blend of modern infrastructure, business-friendly environment, and favorable investment opportunities, making them an attractive destination for local and international investors alike. Over the past four decades, they have also made significant strides in enhancing regulatory frameworks and strengthening governance, further enhancing the region’s appeal as an investment destination.

Significant Oil & Gas Reserves - Region collectively holds nearly 30% of world’s proven oil reserves with Saudi Arabia holding 16% of global oil reserves. Additionally, Qatar holds substantial natural gas reserves including world’s third largest reserve of natural gas.

Strong Economic Growth - Strong economic growth over the past few decades, due to its abundant natural resources, strategic location, and investment in infrastructure development. The region has remained resilient over the past five years with Nominal GDP recording an annualized growth of 7.8% between 2017 and 2022. It is expected to continue to grow at a higher pace than other developed markets and average at around 3.4% over the next five years.

High GDP per capita - It is one of the most affluent regions in the world with high levels of per capita income. This is indicative of a high level of economic development and purchasing power.

Growing Young Population - Large and growing consumer markets, due to high population growth. The population has been growing consistently and is expected to increase at an annualized rate of ~2% between 2022 - 2027 to over 66.2 million. The proportion of young working-age population is also high and projected to reach approximately 58% by 2027.

Diversification Agenda - Seeking to diversify the region's economies away from oil and gas which creates new investment opportunities and reduces reliance on a single commodity. For example, Saudi Arabia's Vision 2030 aims to reduce the country’s dependence on oil and gas by increasing the share of non-oil exports in GDP from 16% to 50% by 2030.

Favorable Business Environment - Known for its business-friendly policies including low tax rates and minimal bureaucracy, making it easier for companies to set up and operate. The GCC is also home to more than 60 special economic zones that offer an array of benefits including 100% foreign ownership, tax exemptions, advanced infrastructure along with one of the lowest energy costs globally. All GCC countries except Kuwait, are pegged to the US$, making the region relatively hedged from currency risks and minimizing exposure to currency and export revenue volatility.

Global Connectivity - Geographical proximity to South Asia & Africa and home to the world's busiest airports and container ports augurs well for the region to emerge as a manufacturing and trading hub. Furthermore, these countries are investing heavily in infrastructure projects including airports, ports, highways, and railways to further improve the connectivity within and outside the region and create new opportunities for businesses.

Market Overview

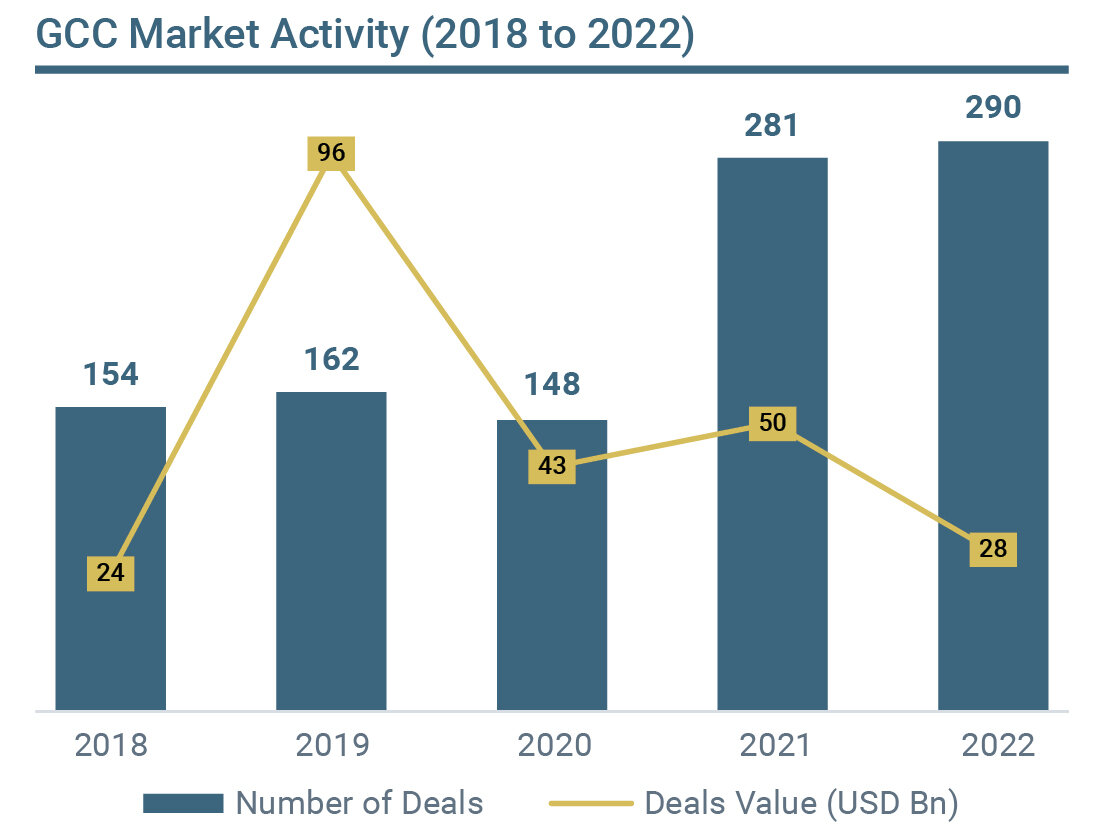

The GCC region is a dynamic hub of development and transformation, and its M&A landscape has been closely aligned with this progress. Over the past five years, the GCC has experienced a significant surge in M&A activity, with a total of 1,035 deals valuing at least a staggering US$ 241.4 billion1. This upward trend is evident in the substantial increase in the recorded number of deals, rising from 154 in 2018 to 290 in 2022, an 88% increase. Despite the unprecedented challenges posed by the COVID-19 pandemic, the region recorded 148 deals in 2020, demonstrating remarkable resilience and continuous advancement. This underscores the region’s consistent improvement and development, highlighting its growing prominence as a key player in the global M&A arena.

Among the six countries comprising the GCC, Saudi Arabia and the UAE stand as the dominant forces, commanding a substantial share of both the number and value of M&A deals. These two countries collectively account for over 85% of the total number of deals and deal value within the region. Notably, the UAE has witnessed a remarkable 678 deals since 2018, accumulating a total reported deal value of US$ 86 billion2. On the other hand, although Saudi Arabia has recorded a relatively lower number at 268 deals, the value of these deals reached an astounding US$ 143 billion.

Investor Profile

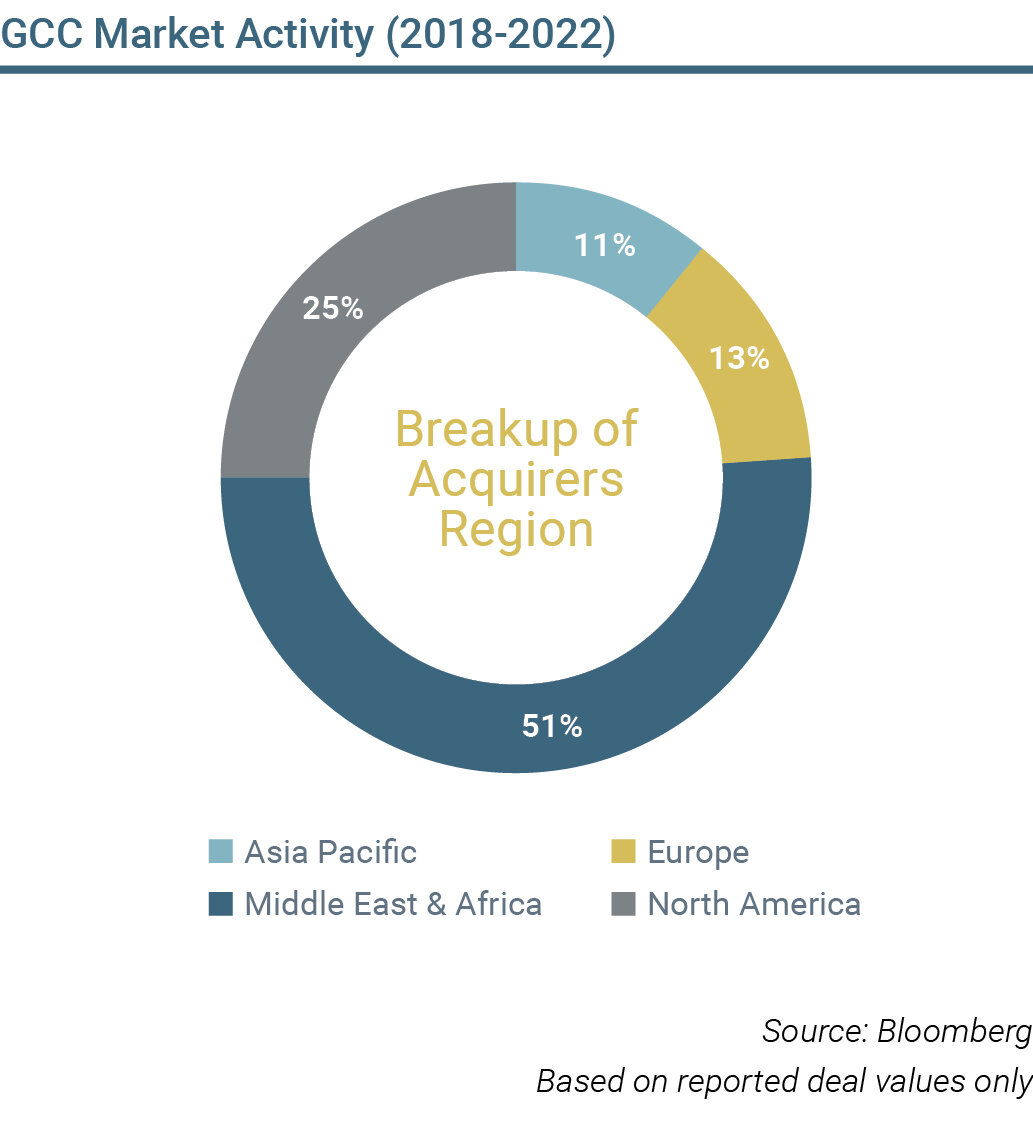

A significant proportion of M&A transactions in the GCC are driven by acquirers from the Middle East, particularly within the GCC itself. With investors from the Middle East and Africa (MEA) region contributing to more than half of all transactions, it is noteworthy that Saudi Arabia and the UAE collectively account for over 80% of these deals. On the other hand, the remaining M&A transactions involve acquirers from countries outside the MEA region, highlighting the growing economic significance and global integration of the GCC

Sector Profile

The M&A landscape within the GCC has been characterized by a concentration of activity within the Financial and Technology sectors, which together accounted for nearly half of all deals in the region since 2018. However, the Basic Materials, Energy and Financial sectors have the largest share of deal value with 31%, 24% and 23% respectively.

M&A Outlook

The region's robust M&A activity signifies its attractiveness as a destination for investments and highlights its ongoing transformation in various sectors. Recent trends indicate a growing emphasis on privatizing and diversifying the region's economy, along with continued interest from investors in traditional industries.

Additionally, there is a keen focus on enhancing the capital market and improving foreign direct investments. Looking ahead, the GCC region presents promising opportunities, particularly within the Healthcare, Hospitality and Education sectors as well as various Industrial Manufacturing sub-sectors. As the GCC governments continue to foster economic development and industry growth, these sectors are expected to emerge as attractive investment prospects not only for regional investors, but also for global players

Joining IMAP - Further Strengthening Our Capabilities

Over the past two decades, Alpen Capital has successfully established itself as one of the top investment banking advisory firms in the GCC region Expanding our horizons, we ventured into the Asian market where we advised reputable business groups and financial institutions in India, Sri Lanka, Bangladesh, and Cambodia to meet their strategic objectives. This I success story sandy continued as we embraced opportunities in Levant and Africa, executing multiple deals in various countries like Lebanon, Jordan, Kenya, Tanzania, Nigeria, South Africa, among others. Our successful expansion into markets beyond the CC demonstrates our ability to thrive in diverse markets and cater to the unique investment needs of our clients. Today, our operational reach extends across 36 countries. from the UK to Vietnam

Collaborating with IMAP offers us a remarkable platform for further growth and consolidation in both the developed and developing markets. Building on our strong presence in the region, this partnership expands our reach further to source and execute transactions in collaboration with other IMAP partner firms worldwide. At the same time, other IMAP members will also benefit from our extensive network of relationships and expertise in our operating markets. Since joining IMAP, we have engaged with more than 20 partner firms on various opportunities and mandates across the sectors and we look forward to leveraging this alliance to unlock even greater value for our clients.

Energy

- Major oil and gas producer and exporter

- Rising interest in renewable energy

- Expansion along the value chain to add more in-house capabilities

Healthcare

- Growing aging population and high prevalence of Non-communicable diseases (NCDs)

- Increased Focus on Preventive Care

- Advancements in Precision Medicine and Personalized Care

Hospitality

- Mega events scheduled across the region

- Massive development of tourism infrastructure

- Positioning the region as a world-class leisure destination

Retail

- Rising prominence of omni-channel business models

- Increasing disposable incomes

- Thriving consumer culture

Food & Beverage

- Growing population

- Technological advancements in domestic food production

- Rising demand for healthy and organic food

Education

- Rising demand for quality education

- Government initiatives to enhance educational infrastructure

- Growing importance of technology and EdTech platforms