The Evolving Landscape of European Payment Solutions: Trends Shaping the FinTech Industry

The European Payment Solutions market is undergoing a remarkable transformation, from contactless payments, to digital wallets, such as Apple Pay and Google Pay, and instant payments. Driven by technological advancements and shifting consumer demands, robust growth is forecast across key segments, this dynamic sector offers a wealth of opportunities for investors and financial institutions.

Market Dynamics: Growth Across Segments

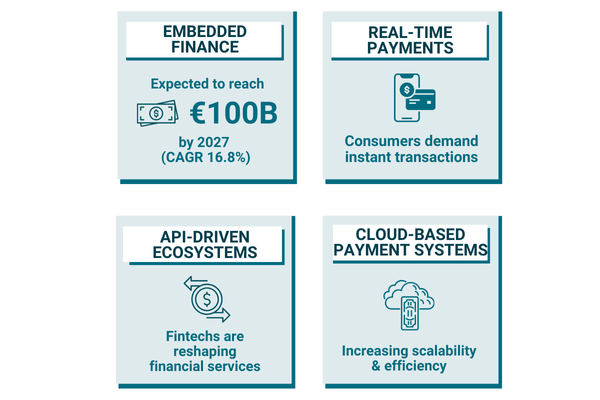

The embedded finance segment, where non-financial companies integrate financial solutions into their customer offerings such as buy now pay later (BNPL), is expereincing significant growth and is projected to reach EUR 100 billion by 2027, with an impressive compound annual growth rate (CAGR) of 16.8%.

Meanwhile, the convergence of payments market—focused on unifying multiple payment methods to improve customer experience—is expected to expand at a CAGR of 12.1% from 2024 to 2030.

Key Trends Reshaping European Payment Services

Several transformative payment system trends are driving innovation and growth:

-

Embedded Platforms: The integration of financial services into non-financial applications is revolutionizing industries by enhancing user experiences and streamlining transactions within existing workflows.

-

Transition from On-Premises to SaaS: The shift from traditional on-premises solutions to Software-as-a-Service (SaaS) models is boosting operational efficiency and scalability. This transition allows businesses to adapt quickly to changing environments while optimizing resource management.

-

Rising Demand for Real-Time Payment Processing: Consumers increasingly expect rapid, instant payment processing, which ensures smoother checkout experiences and reduces cart abandonment rates.

-

Shift to Cloud-based Infraestructure: Traditional market players and legacy credit card processors are moving to the cloud for greater scalability, agility and faster integration with other services.

-

API-Driven Ecosystems: Aplication Programming Interfacess (APIs), such as Stripe, Square, and Braintree are becoming essential tools for businesses seeking agility and adaptability. By enabling web and mobile applications to accept payments they create flexible and scalable systems, APIs allow companies to respond swiftly to market changes and provide tailored financial services.

-

FinTech Disruption: FinTech players are emerging as key disruptors in the industry, driving innovation in back-end software for embedded finance. Their cutting-edge payment solutions are challenging traditional financial institutions to evolve and compete in this fast-paced environment.

Strategic Opportunities for Investors

Investors looking to capitalize on the European Payment Solutions market should consider several strategic insights:

Shift in M&A Focus: Mergers and acquisitions in this sector are increasingly focused on capability-driven deals rather than large-scale megadeals, emphasizing innovation and niche expertise as key drivers of value creation.

Agile Startups Leading Innovation: Early-stage companies leveraging unified payment systems are gaining competitive advantages by offering streamlined solutions that meet evolving consumer expectations and customer experience.

Forecasts Highlight Potential

The outlook for European Payment Solutions is highly promising:

-

Capgemini Research Institute projects a 12% CAGR for non-cash transactions between 2023 and 2028, reflecting the growing shift toward digital payments across Europe.

-

McKinsey & Company predicts that embedded finance alone will generate more than EUR 100 billion in revenues by 2030, further solidifying its position as a cornerstone of the sector’s growth story.

The European Payment Solutions market is at the forefront of digital transformation, offering significant opportunities for investors seeking exposure to high-growth sectors. With strong performance across embedded finance, A2A payments, card payments, and convergence trends, this market is well-positioned for sustained expansion through technological innovation and evolving consumer preferences. Investors should closely monitor this dynamic industry as it continues to redefine Europe's financial landscape in the years ahead.