Business Software & Services in Spain: Key Areas of Interest for Investors

The post-COVID boom in the Business Software and Services market may have slowed, but the sector continues to offer interesting opportunities for investment.

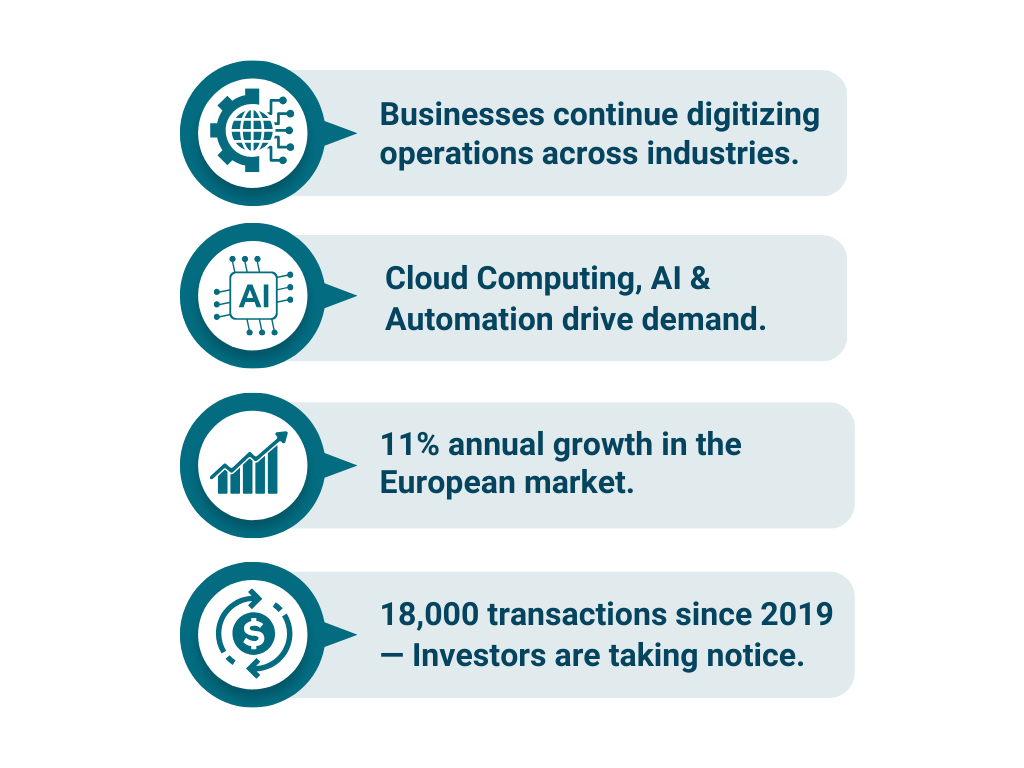

It’s no secret that the COVID-19 pandemic had a favorable effect on the Business Software and Services industry, as client companies moved quickly to digitize and embrace online collaboration. Nevertheless, in many sectors, this digitization continues to focus on the automation of business processes across end-use industries such as Retail, Manufacturing, Healthcare, and Transportation.

The Business Software and Services market comprises several subsectors and is responsible for vast improvements in efficiency and productivity.

The products and services offered facilitate better decision making, inventory cost reduction, improved profitability, increased security, and overall improved market position for businesses.

Current growth is driven by the on-going demand for Cloud computing, the implementation of innovative tech such as Blockchain, Artificial Intelligence and Machine Learning, and the continued need for digitalization of small and medium-sized companies.

Subsectors of the Business Software Market

Business Software and Services is a blanket term used to refer to all software implemented in enterprises. It covers a wide array of functions and can be broken down into subsectors, whose growth and performance vary:

-

Customer Relationship Management (CRM) or Enterprise Resource Planning (ERP) – Streamlines business processes related to customers and resources

-

Marketing and Productivity - Launches and tracks marketing campaigns, and digitizes, automates and improves business tasks

-

Human Resources – Focuses on people management (on-boarding, training, payroll)

-

Infrastructure and Cyber Security – Enables IT systems to operate, minimizes risks of threats, and guarantees data security

-

Industry –Software for the Manufacturing industry or providing corporate services

-

Commerce and Payment – Undertakes and manages online sales, and enables payment transactions

-

Mobility and SCM Logistics – Software which enables mobility and transportation management and facilitates supply chain logistics

European M&A Activity

While the sector is still growing, these figures mark a slowdown on previous years, one which is reflected in the number of M&A deals completed. The total number of deals in the European Business Software and Services sector dropped from 2487 in 2022 to 2298 in 2023. This was in keeping with a slowdown in other sectors, due to several adverse macroeconomic and geopolitical factors, such as rises in interest rates, wars, inflation and raw materials shortage.

Spotlight on the Spanish Market – the 5th Largest in Europe

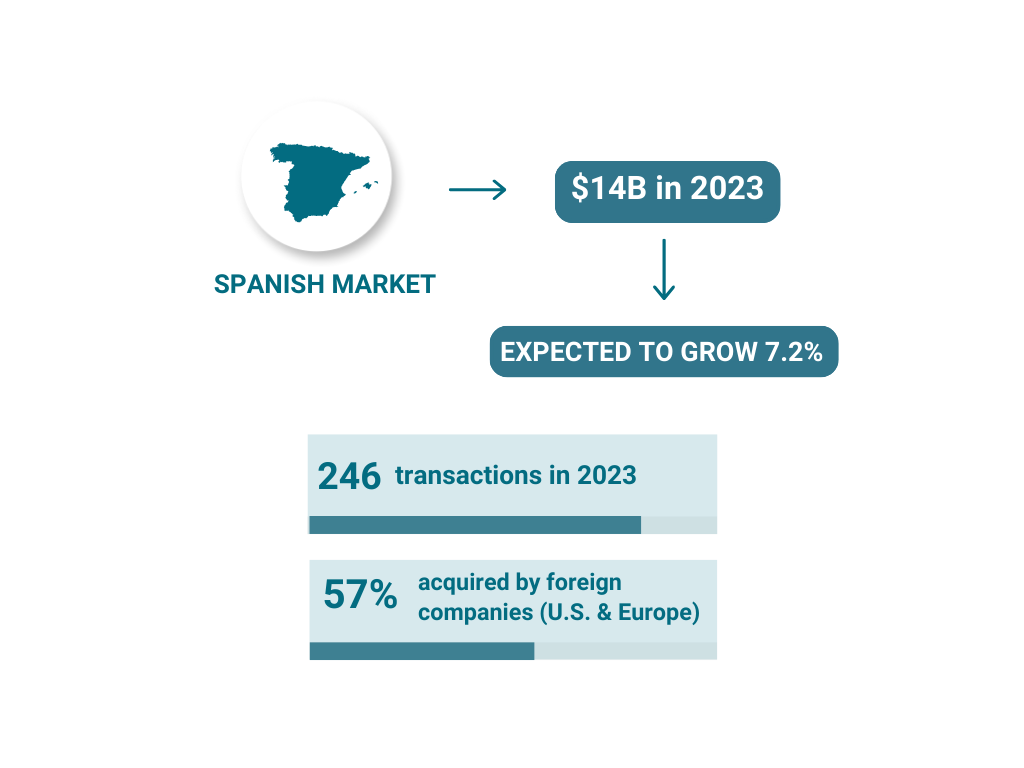

The Business Software and Services market in Spain was valued at USD14 billion in revenue in 2023 (the 5th largest in Europe after Germany, the UK, France, Italy).

-

246 transactions were completed in the sector in 2023, of which 158 were venture capital and 88 M&A

-

57% of Spanish transitions were made by foreign companies (primarily from the United States and Europe), while the rest (43%) were domestic

Various players looking to accelerate and consolidate their growth are contributing to an increase in consolidation of the sector.

A Positive Evolution in Spanish Market

Just some of the clients we have helped Spain include Immoweb, a real estate CRM, IT services and software provider on its sale to Adevinta, as well as the sale of a vertical software company for the Agri-Food sector to Aelis Consulting. More recently, we advised Zucchetti Spain on the purchase of iArchiva a company specialized in the development of software for the automation of processes.

Despite the global slowdown, from which Spain has not been immune, the sector has shown a positive evolution in recent years, and we expect to see growth of 7.2% from 2024-2028.