IMAP Spain Showcases Crop Nutrition Investment Opportunities

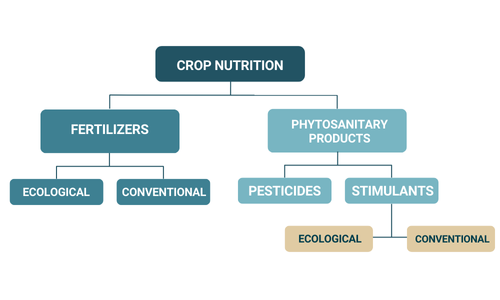

The Crop Nutrition sector (comprised of two main verticals: fertilizers and phytosanitary products) is growing steadily. Propelled by increased citizens’ concern post COVID-19 and macrotrends in climate change, geopolitical tensions, environmental regulations, and resilience to climate factors.

An increasing number of specialized companies have emerged, many of whom have launched new product lines such as bio-fertilizers and bio-stimulants, both of which have a high growth rate due to increasing regulations. In some countries, these ecological options have grown by almost 30% in the last five years.

Increased Investments in Innovation and Brand

Technological advances have a direct impact on the Agrochemical sector as they lead to the creation of new companies with innovative products that are more effective and, generally, more profitable. This is leading to an increase in investments, especially in the Bio or Ecological subsector.

At the same time, we have seen a move away from commoditization towards differentiation, where farmers choose recognized brands, which guarantee quality and results. Similarly, companies are investing in the development of products adapting to new climate patterns and leveraging growing technology to optimize nutrition.

Global Need Drives Growth

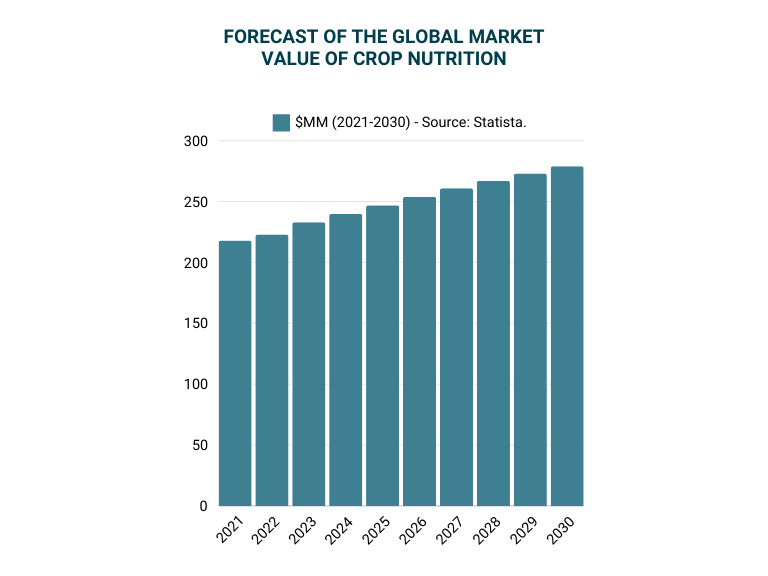

According to the Food and Agriculture Organization of the United Nations, world population is estimated to reach 9.8 billion by 2050. This combined with an increase in purchasing power in emerging markets will lead to a reduction in arable land per capita (from 0.21 hectares per person currently to 0.18 hectares per person by 2050). This scenario will increase pressure on the profitability per hectare, driving growth in the crop nutrition markets. An annual growth rate of 3% is expected until 2030, when the market will reach an estimated size of $279 billion. Growth depends on achieving a more sustainable and efficient agriculture that allows us to satisfy the growing food demand.

The Impact of Regulation

While political measures, based on citizen’s concerns, may affect the sector, some flexibility has been demonstrated. In the case of the European Union, actions taken by the Agricultural sector to oppose the proposal to reduce the use of plant protection products by 50% (under the Sustainable Use of Pesticides Directive) were successful. The European Union has withdrawn the proposal, allowing more scope for investment in innovation to resolve these issues.

Additionally, in many parts of the world new regulations are being created, aimed at reducing the environmental impact of the Crop Nutrition sector. For example, in Europe, starting from 2024, farms must have a fertilization plan that includes specific measures to mitigate emissions of ammonia and other polluting gases. These should be seen as an opportunity for investors.

Sector Dynamics led by Asia

In terms of global sector dynamics, Asia is the primary crop nutrition market, followed by Eastern Europe/Central Asia and North America. Each of these regions has its own challenges. Asia, led by China, faces both a decrease in cultivated areas due to urbanization, and increased awareness in food origin among its citizens. India, another key contributor to the Asia market, is experiencing an increase in crop nutrition usage and a focus on biological pesticides, the latter led by the government as part of a focus on more sustainable agricultural practices.

Eastern Europe/Central Asia have been affected by geopolitical tensions between countries, generating disturbances in the crop nutrition supply chain. For example, potassium export from Russia and Belarus decreased by 30% and 50% respectively.

Dynamic M&A Activity

There has been dynamic M&A activity in the sector over recent months, with major players focusing their activity on cross-border operations in an effort to:

- Consolidate the sector

- Enter new geographic markets

- Diversify their product portfolios

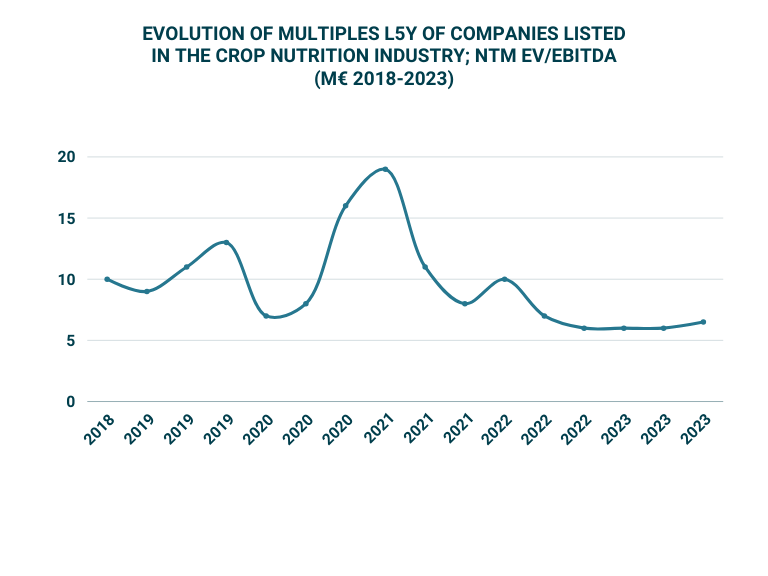

Source: Screening: American Vanguard Corporation, CF Industries Holdings, Inc., Corteva, Inc., CVR Partners, LP, FMC Corporation, Intrepid Potash, Inc., Itafos Inc., The Mosaic Company, The Scotts Miracle-Gro Company

In the US, a series of companies specialized in the sector are listed on public stock exchanges, with an average EV/EBITDA multiple of 10.1x, while the average EV/EBIT multiple stands at 20.6x. In the EU, the average EV/EBITDA multiple stands at 9.6x, the lower multiple due mostly to the size of the target company.

Steady Growth Outlook for the Foreseeable Future

ALBIA IMAP - IMAP Spain foresees a continuation of the corporate dynamism in the sector, albeit with a series of nuances. We expect to see investors becoming increasingly selective, preferring companies whose products are more environmentally friendly. It is likely that financial investors will continue to pursue opportunities in the sector, although the higher cost of capital will affect both their level of activity and their valuations.