Capstone Partners (IMAP USA) Reports on Food Market M&A Activity

Food M&A Market Remains Active, Buyers Focus on Product Volume Growth

Merger and acquisition (M&A) activity in the Food sector has remained strong through year-to-date (YTD), with a healthy pool of acquisitive strategics and sponsor-backed businesses supporting transaction activity. While heightened food inflation plagued consumers for much of 2023, the sector’s M&A market has persevered as participants’ raised prices in accordance with inflation. The impacts of food price deceleration on company performance and M&A opportunities will heavily depend on the subsector. The Branded subsector has continued to yield considerable levels of M&A activity to-date as strategics have vertically integrated value-added products with strong brand recognition. Notably, M&A activity in the Distribution space will likely trail other areas of the sector as distributors lose pricing power.

Food M&A Volume Remains Robust

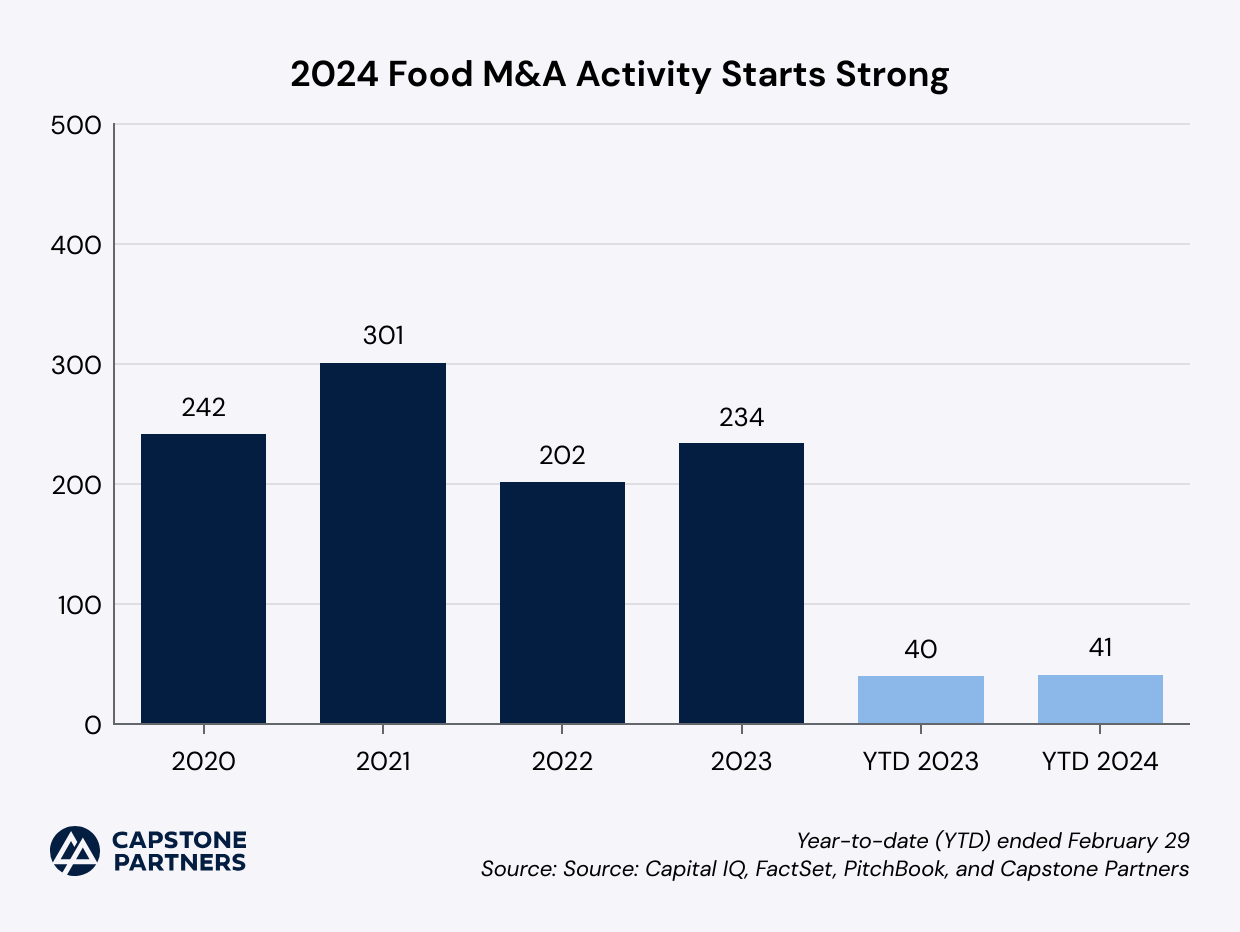

M&A activity in the Food sector has persisted despite broader macroeconomic headwinds. Sector deal volume has reached 41 transactions announced or completed YTD, on pace with YTD 2023 levels (40 deals). Sector transaction activity has also outperformed the broader U.S. M&A market, which experienced a decline of 24.1% YOY in 2023. Inelastic consumer demand for food products has upheld many sector participants’ bottom lines throughout recent input price hikes. In addition, input cost increases have often been passed on to the consumer, further bolstering participants’ revenue and earnings. These factors have continued to incite buyer interest in the Food sector, especially for branded food and food processing businesses with product volume-driven earnings growth.

Strategic buyers have continued to control the Food M&A market. Strategics accounted for 65.8% of sector deals in 2023 and have comprised 51.2% of transactions YTD. Private equity firms remained on the sidelines for much of 2023 as an elevated interest rate environment hindered transaction financing. Despite this, financial acquirers have comprised nearly half (48.8%) of Food sector deals in YTD. While it may be too early to categorize this uptick as sponsors’ reentrance into the M&A market, certain pockets of the sector have undoubtedly garnered heightened buyer interest from sponsor-backed acquirers. Of note, private equity add-on engagements in the Branded subsector have risen 250% YOY in YTD 2024. Sponsors’ eventual return to the M&A market will likely be catalyzed by limited partner (LP) pressure to generate returns and the significant levels of dry powder left to deploy, totaling $1.5 trillion in 2023. In addition, the majority ($955.7 billion) of dry powder is held in U.S.-domiciled funds, providing a favorable outlook for stateside deals in 2024.

Valuation Insight

M&A transaction multiples in the Food sector have remained robust, averaging 1.9x EV/Revenue and 12.8x EV/EBITDA from 2021 through YTD. Sector purchase multiples have continued to outpace valuations in the broader Consumer industry, which averaged 1.8x EV/Revenue and 10.4x EV/EBITDA during the same period. While there have been a number of large-scale acquisitions in the Food sector during this period, middle market participants with sticky customer bases and significant revenue visibility have commanded strong M&A pricing. Purchase multiples for middle market deals in the Food sector have averaged 1.9x EV/Revenue and 12.6x EV/EBITDA from 2021 through YTD. Capstone expects M&A pricing in the sector to remain healthy throughout 2024 as acquirers look to submit competitive bids for quality assets.

The above is an excerpt from Capstone Partners’ April 2024 Food M&A Coverage Report. For more than 20 years, Capstone Partners has been a trusted advisor to leading middle market companies, offering a fully integrated range of investment banking and financial advisory services uniquely tailored to help owners, investors, and creditors through each stage of the company's lifecycle. Capstone Partners is IMAP's partner in the USA. To learn more, visit www.capstonepartners.com.