2024-2025 Global M&A Trends Report: Positive Outlook for Mid-Market Dealmaking

In conjunction with Capstone Partners – IMAP USA, we are pleased to present the 2024-2025 Trends in Global M&A Report, an insightful look at the evolving landscape of mergers and acquisitions (M&A).

With input from 100 senior IMAP dealmakers across 54 countries, this extensive report explores critical trends, challenges, and forecasts for the mid-market M&A space.

Following economic headwinds over the past two years—including high inflation, tight financing conditions, and low business confidence—global dealmaking conditions are improving. The outlook for 2025 is optimistic, marked by the expected resurgence in private equity activity and increased confidence from both acquirers and sellers.

Key Insights from the Report:

Deal Flow Recovery & Private Equity Resurgence

After a slow start in 2024, signs of recovery were evident by the end of the year.

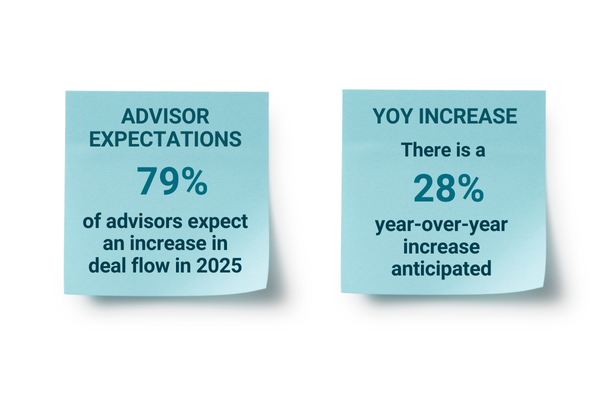

- 79% of dealmakers surveyed expect deal flow to increase in 2025, compared to only 50% last year

- The much-awaited return of private equity investors is anticipated, with both acquisitions and exits driving deal activity as high levels of dry powder and easing credit conditions help to fuel deals

Industry Consolidation & Succession Planning

Succession planning will continue to be a dominant force shaping the M&A landscape.

Horizontal consolidation and capital raising are also is also expected to gain momentum as companies seek to strengthen their market positions.

Valuation Trends & Sector Hotspots

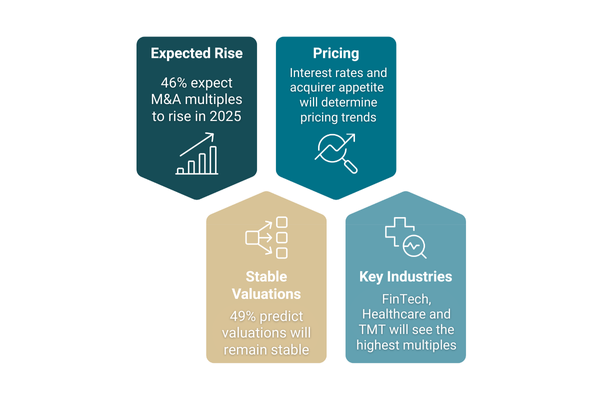

M&A transaction multiples are expected to tick up in 2025.

- 46% of dealmakers predict a moderate rise in transaction multiples for 2025, signaling strong interest in premium assets

- Key industries expected to see the highest multiples include

- FinTech, Healthcare, Technology, and Aerospace/Defense

Macroeconomic Factors

As major central banks reduced interest rates in late 2024, further cuts are expected in 2025, driving increased market confidence. However, inflation remains a challenge, and geopolitical factors continue to create trade uncertainties.

Why Download the Report?

This comprehensive study offers actionable insights into:

- Market conditions and deal flow forecasts

- Valuation trends and industry hotspots

- The resurgence of private equity investors

- Sell-side M&A considerations

- Global economic impacts

- Challenges and strategic opportunities for dealmakers