Reimagining Retail: The GCC's Path to a Post-Oil Economy

As the world grapples with moving beyond fossil fuels, the GCC's Retail sector has for some time been a bright spot in the region's economy and a blueprint for economic diversification in resource-dependent nations. The numbers tell a compelling story. The latest report by Alpen Capital – IMAP GCC projects the GCC Retail market will grow from $309.6 billion in 2023 to an impressive $386.9 billion by 2028, at a CAGR of 4.6%.

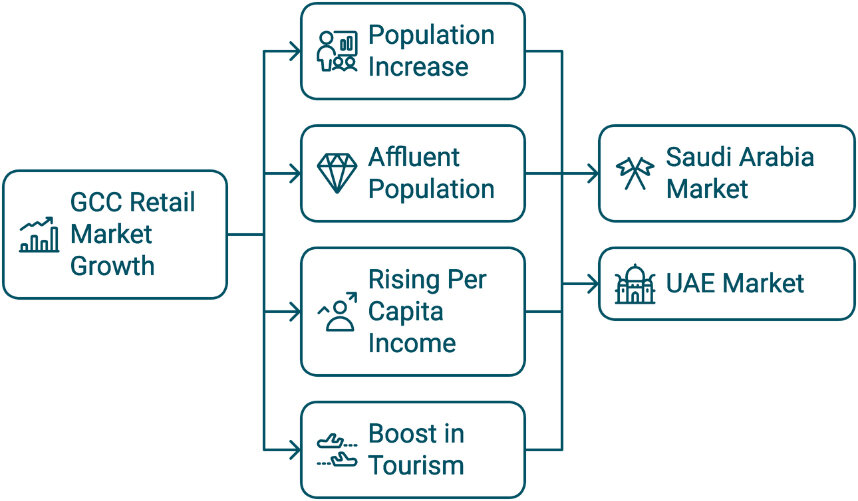

This growth is underpinned by a steady increase in population, which has expanded at a 1.5% CAGR since 2018, reaching 57.1 million in 2023. Other factors supporting growth are the region’s affluent population, rising per capita income and boost in tourism activities. Saudi Arabia and UAE are the largest markets in the GCC that are driving growth with projected CAGRs of over 5%.

Redefining the Shopping Experience

Beyond these impressive figures lies a more nuanced narrative of transformation and opportunity. The GCC's retail revolution is not merely about selling more goods. It's about reimagining the fabric of these societies. The traditional mall, reinvented as a nexus of community and entertainment in the 2000’s, is being expanded to meet rising demand, while adding enhanced shopping experiences and entertainment. The projected addition of 3.9 million m² of retail space between 2023 and 2028 (a 19% increase over 5 years) shows the region’s commitment to this development.

Similarly, the GCC’s embracement of cutting-edge retail technologies such as the rapid adoption of omnichannel strategies, AI-driven personalization, and fintech solutions like "Buy Now Pay Later" schemes has transformed the shopping experience. The E-commerce sector exemplifies this digital transformation. This rapid growth was accelerated by the COVID-19 pandemic, which shifted consumer behavior towards online shopping.

Leveraging Geographical Advantages

The Duty-free sector, projected to reach $4.7 billion by 2028 with a CAGR of 9.3%, exemplifies the GCC's unique position. As a global transit hub, the region is leveraging its geographical advantage to create a retail niche that few other markets can match. This is economic diversification in action - turning a quirk of geography into a thriving industry.

The Luxury Retail market further underscores the GCC's distinctive retail landscape. The Personal Luxury Goods market in the Middle East, primarily driven by the GCC, reached $14.7 billion in 2023 and is expected to grow to $20.2 billion by 2028, at a CAGR of 6.5%. This growth is fueled by the region's high concentration of high-net-worth individuals and a growing appetite for global brands.

Aligning Retail with National Visions for Economic Transformation

However, the true power of the GCC's retail strategy lies in its alignment with broader national visions. From Saudi Arabia's Vision 2030 to the UAE's Green Agenda 2030, Retail is being positioned not just as a sector, but as a catalyst for social and economic change. It's creating jobs, fostering entrepreneurship, and even driving tourism. Further impetus for the Retail sector should come from initiatives taken by the GCC governments to stimulate retail infrastructure projects and boost tourism through liberalization reforms, in addition to easing business and visa regulations.

Charting a Sustainable Future

Yet, challenges remain. The sector's vulnerability to oil price fluctuations and geopolitical tensions cannot be ignored. The intensifying competition and pressure on profit margins are real concerns, as evidenced by the need for aggressive promotional campaigns and deep discounts to drive revenues.

Strategic Consolidation: M&A Trends in GCC Retail

Since the beginning of 2022, the GCC has witnessed 19 M&A deals, several of which were cross-border transactions, in which companies focused on strengthening their geographical presence while also expanding and diversifying their product offerings.

Saudi Arabia and the UAE continue to attract a significant portion of these deals, with 17 out of 19 involving one or both countries. Noon’s acquisition of Namshi in 2022 for US$335.2 million was one of the largest deals between the two nations in recent years.

As retailers navigate a challenging market characterized by intense competition and margin pressures, consolidation is expected to intensify, enabling them to leverage synergies and position themselves for sustainable growth in an increasingly digital retail environment.

A growing trend among key industry players is the use of capital markets to drive growth. Spinney’s recent IPO, which oversubscribed by 51 times and Lulu Group’s planned listing [offering a 25% equity stake], highlight the increasing reliance on public markets to raise capital for expansion.

The GCC's Retail sector is a case study in economic reinvention. The region demonstrates how traditional resource-based economies can pivot towards a more sustainable, diversified future. For global business leaders and policymakers, the sector offers valuable lessons. It shows how a blend of cultural understanding, technological adoption, and strategic vision can transform an entire economic sector. More importantly, it illustrates how Retail - often seen as a barometer of economic health - can be leveraged as a driver of economic transformation.