What Business Owners Should Know About Trends in ESG

In recent years, Environmental, Social and Governance (ESG) factors have become core elements of corporate strategy, particularly for international and listed companies. They are often used to identify non-financial risks and to highlight development opportunities. At the same time, they can be employed to measure the long-term sustainability of a company. In corporate transactions, these factors are important since they impact the performance and therefore, the value of the company. Here’s what you should know about recent developments in this area.

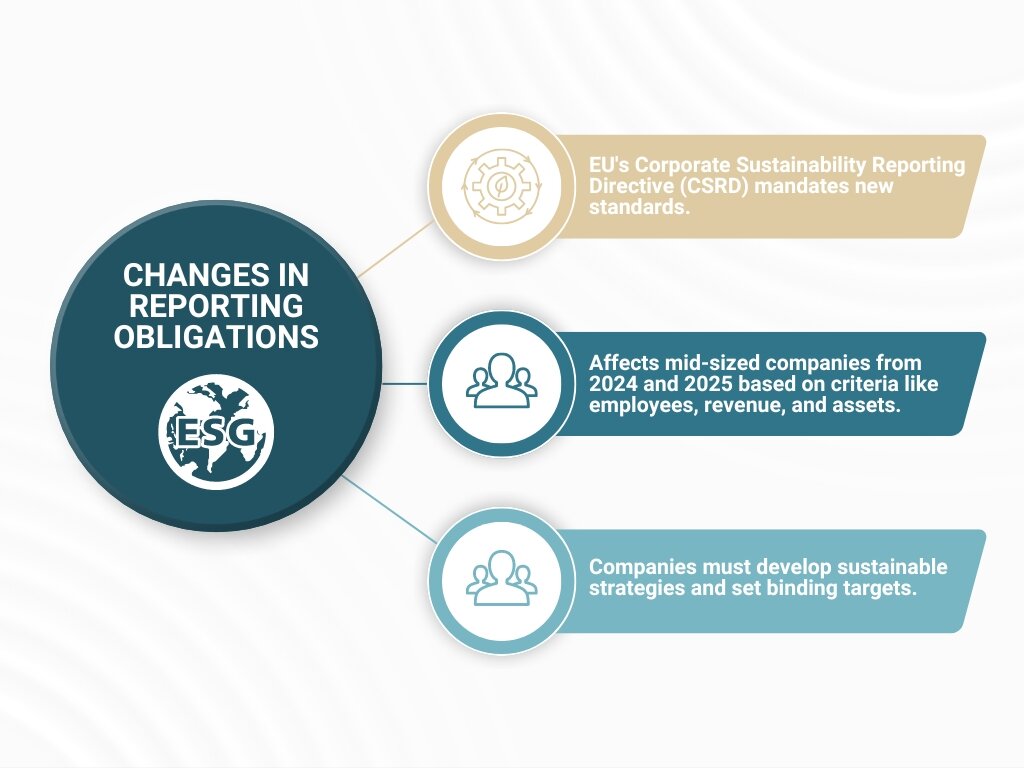

1) Changes in Reporting Obligations

Governments have reacted to the ESG trend by announcing comprehensive changes in annual reporting for mid-sized companies. In 2017, with the implementation of the CSR Directive, the European Union obliged large capital market-oriented companies to address the issue of ESG in their annual reports. More recently, at the end of November 2022, Brussels adopted the Corporate Sustainability Reporting Directive (CSRD) which aims to introduce a Europe-wide reporting standard for non-financial reporting.

How the new sustainability reporting obligation affects a company depends on its size. From the 2024 financial year, companies that are already required to report under the CSR Directive will be bound by the sustainability reporting obligation. From the 2025 financial year, companies that meet two of the three criteria (i) at least 250 employees, (ii) at least EUR 40 million in sales revenue and (iii) at least EUR 20 million in total assets will be required to prepare reports.

While the exact standards for the expanded reporting have not yet been determined, companies affected should prepare for the changes in good time. This includes, among other things, developing a sustainable business strategy and setting binding sustainability targets. Companies should also examine their supply chain to ensure that these targets are met, and be accountable for the use of resources, business ethics, corporate culture, and diversity policy.

The introduction of ESG reporting standards may represent a major challenge for businesses, but it also provides an opportunity to improve sustainability performance, as well as strengthen the company’s reputation with stakeholders. Companies should not only prepare for the upcoming changes, but also take the necessary steps to ensure that they can document their performance transparently and reliably.

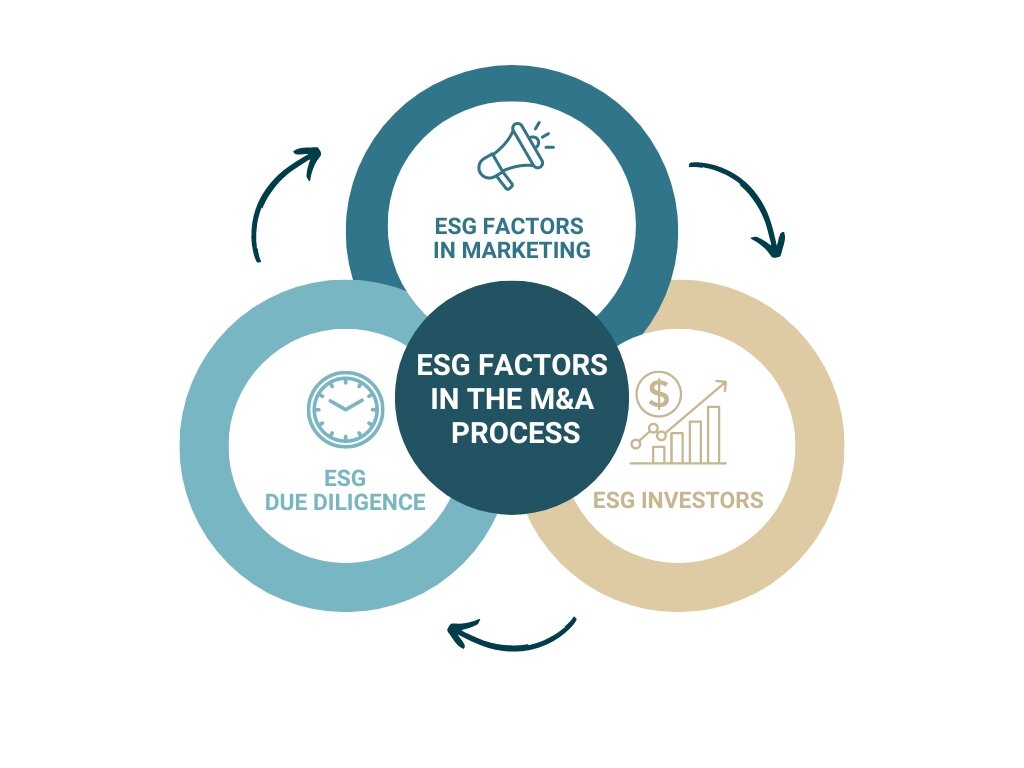

2) Integration of ESG Factors in the M&A Process

ESG not only brings additional complexity to company management on a day-to-day basis, but also when it comes selling a company through an M&A transaction. However, the target’s ESG compliance eases the task of the potential investor as it minimizes the transaction and valuation risk. Consequently, an inadequate level of compliance on the part of the seller, can have a negative impact on the purchase price or on legal exemptions and guarantees for the buyer. So how should we deal with ESG in an M&A transaction?

a) Highlight ESG Factors in Marketing

As part of the M&A process, we should integrate the company's ESG policy into the equity story and thus the sales documentation, highlighting the unique selling points that result from ESG compliance. This applies to the company’s products or services, but also its internal processes and key ESG facts such as certifications, ESG-compliant supply chains, recycling rates or CO2 savings. Even companies that have been unable to keep up with their ESG development, or for which the business-intrinsic ESG factors are not immediately obvious, should position their existing ESG compliance in the best possible light.

b) ESG Due Diligence - the New Audit

Recently, in addition to financial, commercial, tax, and legal issues, investors are placing emphasis on ESG compliance at the due diligence stage. An ESG due diligence process serves to identify and assess potential risks and opportunities related to ESG factors to ensure the company's long-term value creation. The audit can also help protect the integrity of the company and the reputation of the investor.

The following should be considered:

-

Environment: environmental management systems, emissions, and pollution (ecological footprint), as well as impact on ecosystems and resource efficiency (energy, water, waste, etc.)

-

Social: stakeholder management systems, supply chains (in relation to human rights, corruption, etc.), occupational health and safety, diversity, and equal opportunities

-

Governance: risk management systems, cybersecurity/data protection, and competition law behavior

We recommend collecting the relevant documents and carrying out an initial "quick ESG check" together with the M&A consultant before due diligence. At this stage, if there is a lack of documentation, steps can be taken early to be able to give investors a comprehensive picture of the company's ESG compliance.

c) A New Species in the Investor Market: ESG Investors

Private equity investors are increasingly pushing for funds to implement their own ESG standards - both for existing and new portfolio companies and in their own company. Failure to implement these standards can lead to problems with capital commitments from investors. For this reason, a new group of investors with a clear focus on ESG has developed within private equity in recent years. In addition to examining a company's overall carbon footprint, the focus is on "value creation". Behind this broad term is a clear strategy to position and develop the company sustainably in ESG-relevant areas and to make this development potential visible and measurable.

3) Proactive Handling of ESG From the Outset

Now is the ideal time for companies to address many relevant factors applicable in sustainable company succession. In addition to large strategic investors who are interested in ESG in various sectors, financial investors are starting to focus on it. We recommend checking the ESG compliance of potential target companies as part of the preparation phase in the M&A process and then incorporating it into the rest of process as a value-driver. An in-depth review of compliance is also recommended for companies where ESG factors are not immediately apparent or are intrinsic to the business. Careful selection of professional M&A consultants with sufficient experience in the ESG environment will be vital.

As we have seen, paying careful attention to ESG matters goes far beyond simple compliance and should be seen as a way to add value, reduce risk and future proof your company or transaction.