German Commercial Real Estate: Stable Yields & Growth

The German Commercial Real Estate market – specifically the Office segment - has faced significant headwinds in recent years, with high financing costs and economic uncertainties leading to a sharp decline in investment activity. However, recent data suggests a potential turning point, with opportunities emerging for astute investors who can navigate the evolving landscape. Here we delve into the current state of the German Commercial Real Estate market, highlighting key trends, drivers, and investment strategies for 2025.

Transaction Activity: A Shift in Focus

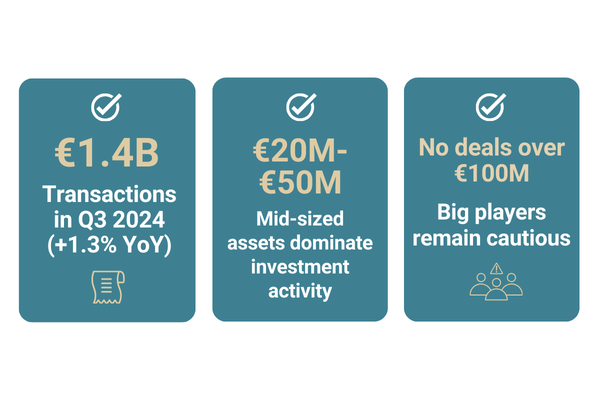

The German Real Estate market has experienced a notable shift in transaction activity. Over the past two years, high financing costs resulting from prevailing market conditions have drastically reduced investment volume. In Q3 2024, the total transaction volume in German cities reached EUR 1.4 billion, a modest 1.3% increase compared to Q3 2023 (not annualized).

This limited activity is not uniform across the market. There's a distinct trend towards larger cities and smaller assets. Specifically, most deals are concentrated in the "A locations," the largest German cities. Notably, there were no reported deals exceeding EUR 100 million in Q3 2024, indicating a reluctance among large institutional investors to commit to high-value transactions who typically require minimum ticket sizes and focus on prime, well-let assets in prime locations.

Consequently, smaller and medium-sized properties, as well as those requiring active management due to letting status or construction age, are often overlooked. Furthermore, institutions are increasingly selling off these types of properties to streamline their portfolios.

This situation creates a unique opportunity for active asset managers and Real Estate investors, who focus on smaller assets with specific value-add potential capitalizing on the enriched pipeline of German Real Estate for sale.

Prime Yields: Stabilization on the Horizon

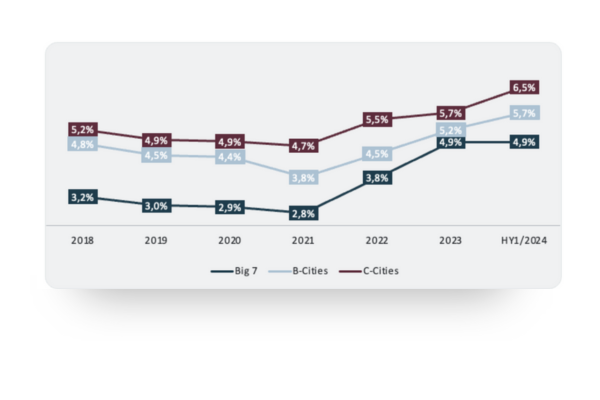

Prime yields for Commercial Properties in German cities have increased due to the changing interest rate environment and the impact of macroeconomics on property. Higher interest rates, a response to inflation expectations, coupled with geopolitical tensions like the Ukraine conflict, have heightened the perceived risk associated with property investments, driving up yield requirements.

However, market participants believe that the repricing of assets has largely concluded, and yields are beginning to stabilize. While 2024 saw a slight recovery in the German Residential Property market, experts anticipate that 2025 will be the year when commercial property yields stabilize and demand for commercial Real Estate investments increases.

As of Q3 2024, net prime yields for office properties varied across German cities. Munich recorded a yield of 4.2%, while Frankfurt stood at 4.5%. Other B/C-cities like Freiburg and Regensburg saw yields of 4.7% while Chemnitz and Leipzig exhibited higher yields reaching 5.0% and 5.3%, respectively.

Market Drivers in German Real Estate: Navigating the Key Influences

Several key market drivers are shaping the German Commercial Real Estate landscape.

Investors anticipate a trend reversal from 2025 onwards, with prices bottoming out and interest rate levels stabilizing.

This expectation is fueling a "flight to quality," as investors seek to avoid investing in potentially stranded assets.

-

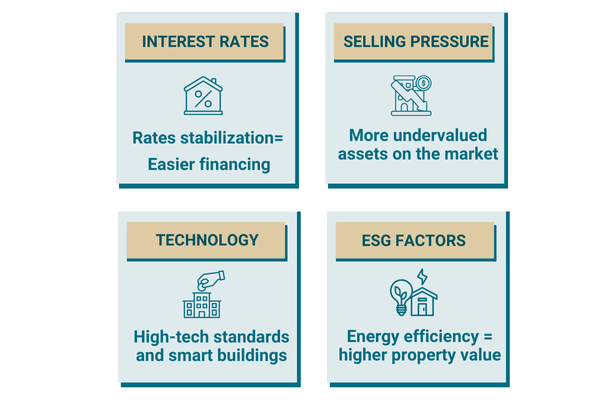

Macroeconomic environment: The expected recovery from 2025 onwards, coupled with the anticipated stabilization of interest rates, should ease financing markets for property investors. The revaluation of assets due to higher interest rates is expected to halt, providing more clarity and stability in the market

-

Competition and sales pressure: Increased selling pressure from "passive" investors looking to offload "undermanaged" properties is creating new investment opportunities for specialized players who can actively manage and improve these assets

-

Environmental, Social, and Governance (ESG): There's a growing recognition of the value of energy optimization in commercial properties, with new laws on energy efficiency enhancing the value potential for specialized players

-

Technology: Increasing attractiveness of properties with high-tech standards and smart building technologies is expected to boost yield expectations

Investment Strategies: Seizing Opportunities Within the Office Segment

Given the current market dynamics, a broadly diversified investment approach is crucial. Germany remains an attractive investment market, offering stable growth combined with favorable investment momentum. Regional diversification within Germany, focusing on the top 7 and B cities (ABBA), with selective investments in C- and D-cities, is a sound strategy.

The investment backlog in Germany, driven by the shift toward larger cities and smaller investment tickets, enhances the acquisition pipeline for investors who focus on assets that are too capital-intensive for private investors but smaller than those typically targeted by large institutional investors.

The repricing of Real Estate assets has concluded, and yields are beginning to stabilize at higher levels, offering attractive entry points for investors.

A focus on commercial properties, particularly office and mixed-use assets, is recommended, while residential, logistics, and retail properties can be considered as part of a mixed-use portfolio.

Tenant diversification, with sector-agnostic tenants with solid credit ratings, is essential, and while long-term leases are beneficial, the contractual rent relative to market rent, renewal probability, and "re-let-ability" of the space are more critical factors.

Yield requirements should balance running cash flows and capital gains at the end of the investment horizon.

Specific investment strategies to consider include:

-

“Cash Cow”: Emphasis on properties with stable cash flows with a long-term lease (10 years +)

-

“Cash Cow with Potential”: Focus on properties with stable cash flows and opportunities for value enhancement at the end of lease-expiry

-

“Modern without ESG”: Target properties constructed from 2010 onwards that can relatively easily be upgraded to meet modern environmental standards, unlocking additional value within the letting-markets, as well as for exits to institutional investors

-

“Premium Seasoned Assets”: Acquire well-maintained, established properties in prime locations

By understanding the evolving dynamics of the German Commercial Real Estate market and adopting a strategic investment approach, investors can use their property investments in Germany to capitalize on the opportunities that are emerging in 2025 and beyond.

Properties investors come back to action with regard to office and mixed-use properties. More and more active investors investigate opportunities outside the top 7 markets and also look at smaller properties. Besides the price tag, aspects such as flexible floorplates and the potential to get the building certified from an sustainability point of view come into focus.