IMAP India: Industrials Update September 2024

Recent News

- After the successful completion of the FAME I & II schemes, the Indian Government has launched the PM E – DRIVE scheme with an outlay of $1.2bn for the promotion of electric mobility in the country

- The US Fed implemented a 50-bps interest rate cut, the first since 2020, reducing it to a range of 4.75% to 5% to stimulate economic activity; Japan and England left its rate unchanged while China reduced its benchmark rate by 0.2% and Brazil increased it first time in 2 years by 0.25%

- India’s manufacturing PMI fell to 56.7 in Sept’24 from 57.5 in Aug’24 indicating the softest expansion in factory activity since January; a PMI value above 50 indicates growth

- Jabil, a global EMS leader, is investing $230mn in a new electronics manufacturing facility in Tiruchirapalli; also US-based Rockwell Automation is investing $79mn Cr in an EMS plant in Kanchipuram

Selection of Recent Transactions

DATE TARGET ACQUISITION

Sep’24 Big Ban Solutions The deep tech defence startup raised $30mn in a fundraise led by Mumbai Angels

Sep’24 Everest Fleet Uber India invested $30mn in the B2B fleet management service provider for a 7% stake

Sep’24 Jindal Rail Texmaco Rails acquired 100% of the railway component manufacturer for $73mn

Sep’24 Clean Max Borosil Renewables acquired 49% of the renewable energy EPC company

Sep’24 Recommercex The E-waste scrap aggregator raised $2.6mn in a fundraise led by Kae Capital Management

Sep’24 Nurix AI The enterprise AI solutions provider raised $27.5 in a fundraise led by General Catalyst

Indian Data Centre Industry – In a high-growth phase!

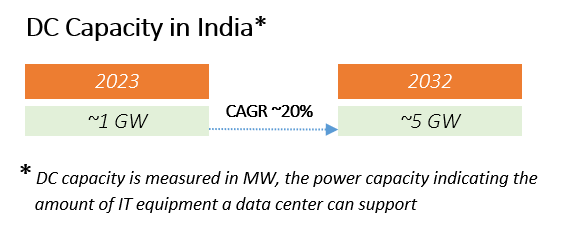

The Indian data center (DC) market is maturing with the influx of long-term stable capital, driven by a strong digital economy, growing internet usage, 5G rollout, and rising demand for AI, edge, and cloud computing.

At present, India has ~245 Data Centers (DCs), making it the 14th largest market globally (with ~45 more to be set up in 2025).

The above capacity addition would entail a capex of US$ 35 billion at ~US$ 7 million per MW (approx. Tier IV data center cost in India). Several players in India have entered the data center business in India from large Indian businesses such as Adani, Sify, L&T, Hiranandani, Airtel to large global players such as Microsoft, NTT and ST Telemedia and relatively younger players such as CtrlS, Netweb and Anant Raj. Also, large scale players such as AWS, Google and Meta are expanding DC operations in India.

The DC growth should also see expansion:

- Real estate players – Currently, DCs in India cover ~11 Mn sq. ft. and the boom will drive significant demand for additional real estate – leading to interest from RE funds/developers

- Server and other ancillary component manufactures – The server market for Indian DCs, stood at ~US$ 3.4 Bn. in 2023, is projected to expand significantly as global players outsource manufacturing needs to Indian firms; ancillary component/service providers such as connectors, cables, coolants, HVAC, etc. are poised to grow

Key contacts

More articles

Poradce je Vaším kompasem.

Obraťte se na nás pro nezávaznou konzultaci se specialistou na fúze a akvizice, který si pozorně vyslechne Vaše potřeby a upřímně a nezaujatě posoudí nejlepší možné řešení.