Capstone Partners (IMAP USA) Reports on AI Adoption, M&A Activity in Healthcare IT

The Healthcare Information Technology (IT) sector has remained strong year-to-date (YTD), primarily driven by healthcare services businesses targeting IT providers to offset labor shortages. In addition, heightened adoption of artificial intelligence (AI) and machine learning (ML) has provided participants with significant revenue and merger and acquisition (M&A) opportunities. Globally, Healthcare IT sector revenue is forecasted to reach $1.9 trillion by 2030 through a compound annual growth rate (CAGR) of 15.8% between 2024 and 2030, according to Grand View Research. North America has continued to dominate the market, comprising more than 40% of global sector revenue in 2023. AI has increasingly permeated the Healthcare IT sector as participants have leveraged custom algorithms to improve preventative care, risk assessment, patient engagement, and cybersecurity.

"While the Healthcare industry historically has not been the fastest adopter of technology, the significant efficiencies and cost savings of AI in Healthcare IT have made this sector one of the most fertile for AI development and revenue expansion, as evidenced by the fast-growing wallet share enjoyed by AI-driven technologies."

David DeSimone

Managing Director, Capstone Partners (IMAP USA)

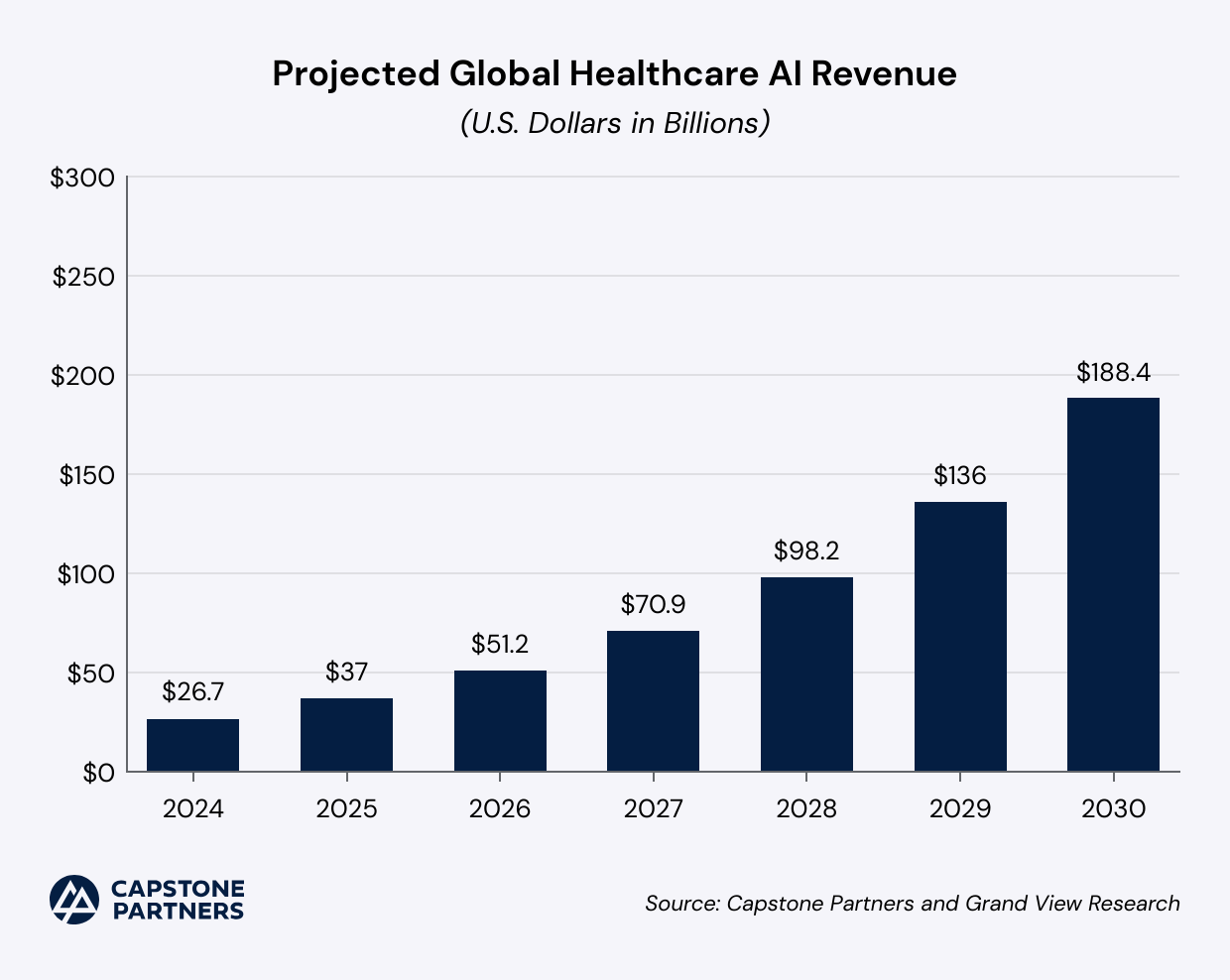

While AI development in many industries has yet to materialize in revenue gains, early AI adoption in the Healthcare space has accelerated the technology’s financial viability. Notably, global Healthcare AI market revenue is projected to reach $188.4 billion by 2030 through a CAGR of 38.5% between 2024 and 2030, according to Grand View Research. AI offerings are forecasted to comprise 10.2% of global revenue in the Healthcare IT sector by 2030, up from 2.9% in 2023. As the technology continues to mature, Capstone expects AI-enabled players to draw significant M&A attention from strategic and financial acquirers.

M&A Volume Rebounds, Valuations Remain Robust

M&A activity in the Healthcare IT sector has rebounded YTD, with 98 transactions announced or completed. While full-year 2023 remained flat, YTD volume has increased 10.1% year-over-year (YOY). In comparison, total M&A activity in the U.S. and TMT industry has declined 16.1% and 10.3% YOY, respectively, during the same period. Healthcare industry defensibility and digital transformation tailwinds have supported elevated M&A activity in the sector. In addition, healthcare services companies have increasingly opted to acquire technology assets rather than develop new systems in-house for speed of implementation.

Strategic buyers have continued to comprise the majority (51%) of YTD sector deals, albeit by a slim margin. Private strategics have represented 35.7% of deals to-date, often rolling up middle market competitors with advanced capabilities such as AI and ML to boost technology stacks. Public strategic buyer activity has experienced the largest decline YTD, falling 31.8% YOY. Public market volatility has inhibited many public players’ available acquisition capital. Select public companies in the space have pursued sponsor backing via take-private transactions to fund acquisition pursuits. Sponsor acquisitions in the sector have proliferated YTD.

M&A multiples in the Healthcare IT sector have averaged 6.2x EV/Revenue from 2021 through YTD, outpacing the average sector multiple from 2018 through 2020 (4.4x EV/Revenue) and 2015 through 2017 (3.7x EV/Revenue). Sector targets with a high degree of recurring revenue and interoperability have continued to garner strong multiples. The sector’s middle market has continued to yield significant levels of M&A activity at attractive valuations. From 2021 through YTD, middle market deals have comprised 83.8% of disclosed sector transactions, drawing an average multiple of 6.4x EV/Revenue during the same period.

The above is an excerpt from Capstone Partners’ July 2024 Healthcare IT M&A Coverage Report. For more than 20 years, Capstone Partners has been a trusted advisor to leading middle market companies, offering a fully integrated range of investment banking and financial advisory services uniquely tailored to help owners, investors, and creditors through each stage of the company's lifecycle. Capstone Partners is IMAP's partner in the USA. To learn more, visit www.capstonepartners.com.

More articles

Poradce je Vaším kompasem.

Obraťte se na nás pro nezávaznou konzultaci se specialistou na fúze a akvizice, který si pozorně vyslechne Vaše potřeby a upřímně a nezaujatě posoudí nejlepší možné řešení.