IMAP Spain Highlights Investment Opportunities in Medical Device Industry

Technological advances in Healthcare sector markets, population aging, and higher life expectancy shape a booming and dynamic industry with an interesting outlook and intense M&A activity.

Market Overview

A Medical Device is any instrument, apparatus, appliance, software, material or article intended by the manufacturer to be used, alone or in combination, for human beings for diagnosis, prevention, monitoring, treatment or alleviation of disease, as well as for investigation, replacement or modification of the anatomy or a physiological process for health purposes.

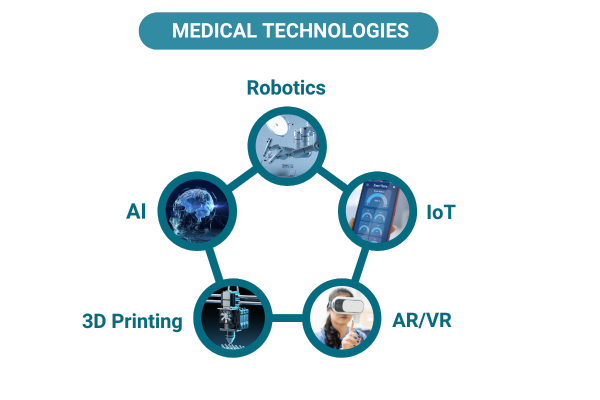

Industry trends herald a shift toward more connected and personalized solutions due to the convergence of technologies such as the Internet of Things (IoT) and artificial intelligence (AI). Additionally, advances in virtual and augmented reality, 3D printing, and medical robotics are transforming surgery, rehabilitation, and device manufacturing.

Focused on finding more ecological solutions, sustainability has also become an essential factor. This hints at an active, thriving, and technologically advanced future for the Medical Device industry.

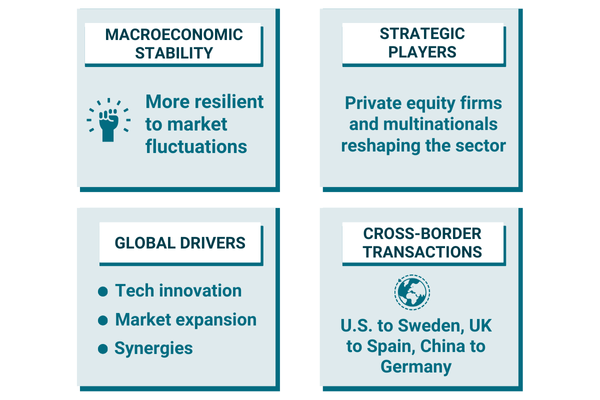

In macroeconomic scenarios like the current one, with inflationary tensions dealt with by central banks through successive interest rate hikes, and growing geopolitical instability, investors traditionally turn to industries that have demonstrated their resilience in past recessions. Listed Medical Device companies are consistently publicly traded at higher valuation multiples than the S&P 500 and S&P 500 Health Care indexes have proven to be more resilient to market fluctuations.

The Global M&A Market

The Medical Device industry is currently in an active period of M&A, and business operations are driven by the pursuit of synergies, portfolio and market expansion, and access to innovative technologies. Top companies such as Johnson & Johnson, Medtronic, and Abbott Laboratories are key players in this scenario as they harness strategic opportunities to strengthen their market presence.

Cross-border transactions in the last year include the acquisition of shares in Swedish non-invasive heart monitor developer, ACORI by U.S. Solardis Health Ventures, allowing ACORI to consolidate its position. And the acquisition of 75% of German Diasys, a company that develops and manufactures in-vitro diagnostic systems, by Chinese Mindray, allowing Mindray to leverage synergies so it can improve the supply chain and enter new segments.

Most M&A activity in the Medical Device industry consists of corporate consolidations to create more complete and diversified entities.

This process seeks to optimize supply chains, leverage economies of scale, and accelerate innovation by integrating complementary technologies. Emerging companies with a specialized focus and disruptive technologies are attractive acquisition targets for established leaders interested in remaining at the forefront of innovation.

Regulatory challenges in the Medical Device industry add an extra layer of complexity to M&A transactions. However, the need to comply with strict rules also drives companies to find strategic partners with experience in compliance and regulations.

Despite these challenges, M&A activity in the industry has an exciting outlook. There are many opportunities and businesses are eager to capitalize on the growth potential and the rising demand for innovative medical solutions. In this environment, all the players involved benefit from significant investments in research and development.

Financial investors have burst onto the scene in recent years. They have been involved in a high proportion of M&A transactions in Europe, seduced by growth and profitability prospects and companies’ interest in partnering with entities that offer financial strength to address industry challenges and experience in transforming businesses during technological revolutions and when entering new markets.

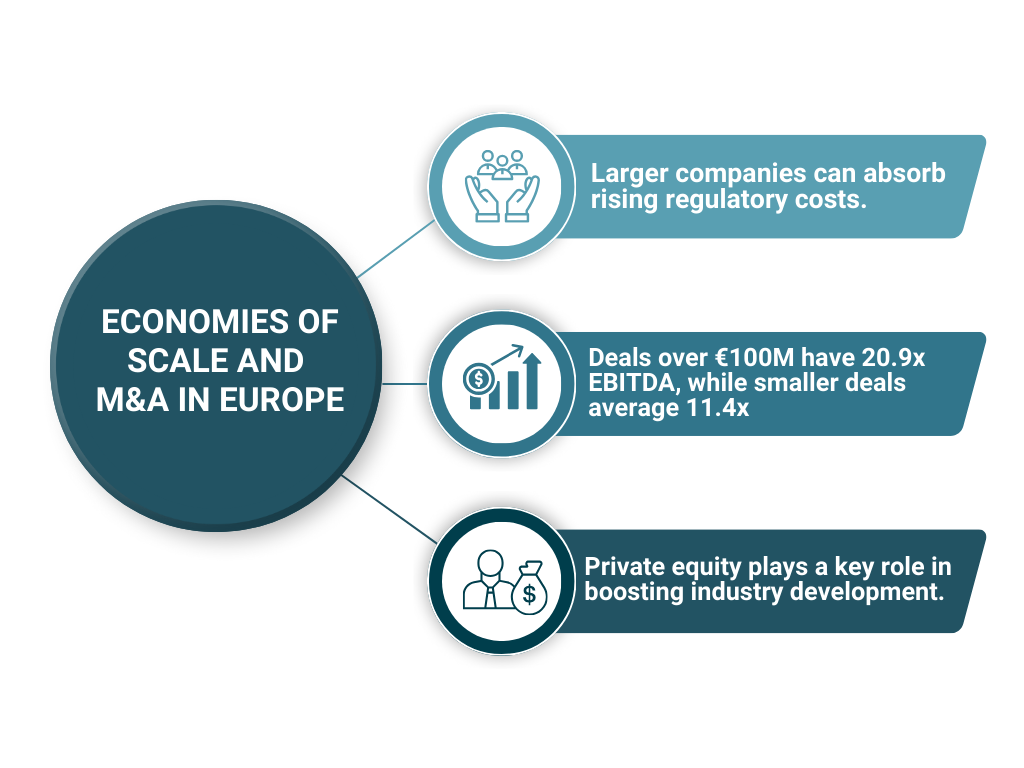

Economies of Scale

Size is critical to absorb the rising costs linked to stricter regulatory requirements, investments for new product development, marketing, and the integration of digital technologies. The higher valuations of larger companies are linked to their ability to address these challenges and achieve economies of scale, which are critical to the industry.

M&A as Catalyst for Growth and Profitability

In line with trends from recent years, strong M&A activity is expected to continue serving as a lever for addressing challenges linked to stricter regulations, new technologies, and access to new markets/internationalization, as well as for consolidation.

Many companies opt for consolidation and growth through financial support from private equity firms. This strategy has become increasingly important as a way to boost expansion and development in the industry.

The industry's intense M&A activity has led to high valuations. The deals analyzed show a median of 13.4x EBITDA in Europe. Investors are only willing to pay a premium valuation for companies that have a robust growth project. In this sense, the significant valuation difference between transactions over €100 million (20.9x EBITDA) and below this amount (11.4x EBITDA) represents an opportunity for investors interested in growth and consolidation deals through smaller companies (low multiples), growing them considerably through low multiple acquisitions and, upon reaching a certain size, selling them at high multiples.

Spotlight on the Medical Device Industry in Spain

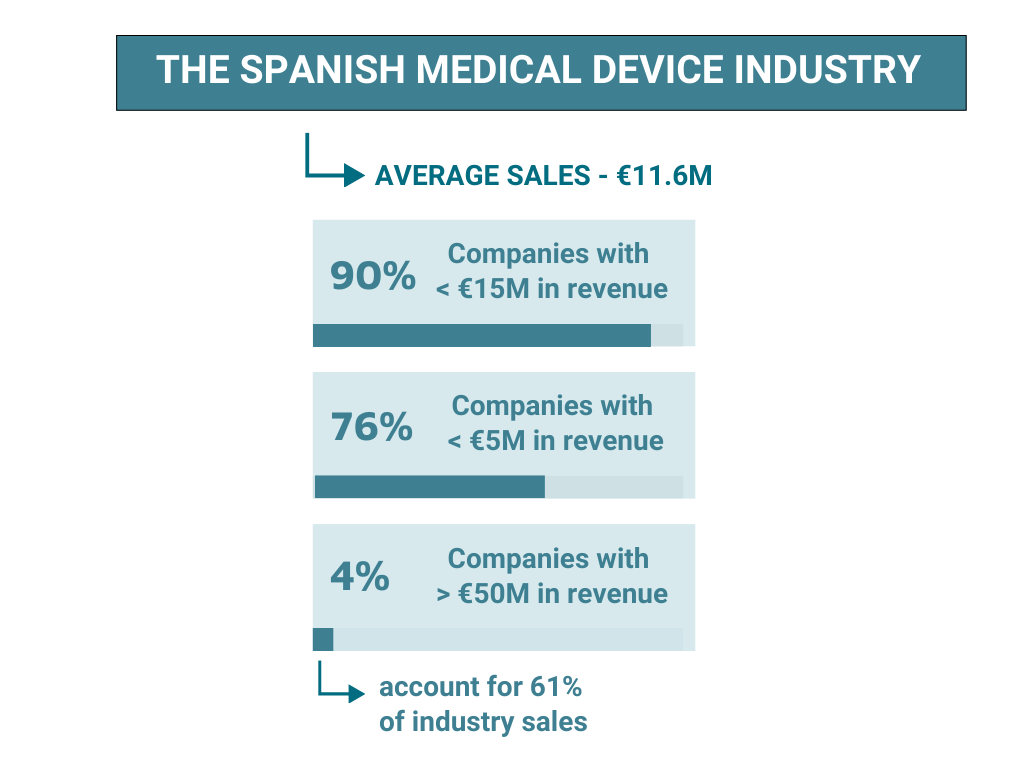

The Spanish Medical Device industry is highly fragmented: average sales are €11.6 million and 76% of the companies have revenues of less than €5 million (around 90% have less than €15 million in sales), thereby restricting its investment potential. Only 4% of industry companies have a turnover of more than €50 million, representing 61% of industry sales.

Regarding the profitability of the Spanish Medical Device sector, the industry financial data show that profitability is interesting: average EBITDA is 12%. Confirming the existence of economies of scale, we find a considerable disparity between the profitability of companies depending on their size. Companies with less than €15 million in sales have an average EBITDA between 9% and 10%, whereas companies with over €15 million in sales have an EBITDA greater than 12% (13% for those with more than €50 million in sales).

This profile has led to the arrival of new players and strategic investors that take advantage of the fragmentation of the Spanish Medical Device industry. These players are more inclined to adopt sudden technological advances, resulting in the ongoing transformation of the industry, challenging traditional dynamics and forcing companies to introduce disruptive innovations that reshape how medical solutions are addressed.

A few that have entered the Spanish market in recent months are Apax, the British private equity fund, through its stake in the innovative healthcare technology solutions provider Palex; Oakley, also a British private equity fund, which has invested in Horizon Opticals, a manufacturer of ophthalmic technologies; and BVI, a US multinational surgical ophthalmology company, which has acquired Medicalmix, a provider of ophthalmic surgical products.

More articles

Poradce je Vaším kompasem.

Obraťte se na nás pro nezávaznou konzultaci se specialistou na fúze a akvizice, který si pozorně vyslechne Vaše potřeby a upřímně a nezaujatě posoudí nejlepší možné řešení.