Three Components Required for a Successful Company Sale

If you’re looking to sell your business but have no idea what to expect, you’re not alone. In fact, most business owners we deal with are going through their first exit transaction, whether as part of their retirement strategy, or as way to raise capital for something else. Whatever the reason for selling, its imperative to get it right.

There are three main considerations or pillars that make a sale successful: Valuation, Deal Structure, and Certainty of Close. We’ll look at each of these and what they mean.

1) Valuation

No one is going to forget about valuation, but what elements are considered in determining how much you can sell your company for? The answer to this is often a frustrating, it depends. There is no formula for dictating valuation, but we consider there to be seven key drivers: growth, cash flow, certainty of cash flow, barriers to entry, synergies, leadership, and sell-side process.

The more attention you pay to these drivers in the years leading up to your exit, the higher the value of your company will be. Let’s take cash flow, for example. This is about how much every dollar you bring in generates (your value-add), as well as the scalability and operational leverage your company has. More than just margin, it’s free cash flow. After all the cash in, and cash out, it’s what you are left with, and as you scale the business, how that grows.

Value is not just affected by the current cash flow, but what is expected in the future. Certainty of future cash flow focuses on the annuity characteristics of your business: your repeat and renew business. Here we’re looking for multi-year contracts, customer tenure, cost controls to ensure the pass through and the margin will remain intact or expand, and what level of execution risk you have.

Buyers will pay a premium for growth, cash flow, and certainty, but they want to know you’ve put a fence around the business you’ve built. What they are looking for is barriers to entry. There are certain steps you can take to ensure your competitive advantage is maintained. Buyers will be looking out for things that set your company apart such as, intellectual property registration, customer and/or vendor switching costs, technological advantages, brand equity/reputation, contractual terms, and know-how.

Another important aspect is the sell-side process, which is concerned with driving value through creating enough competitive tension in the process. It may include three pivotal points to stretch buyers’ credibility and is about getting the right advice on how to build the process.

2) Structure

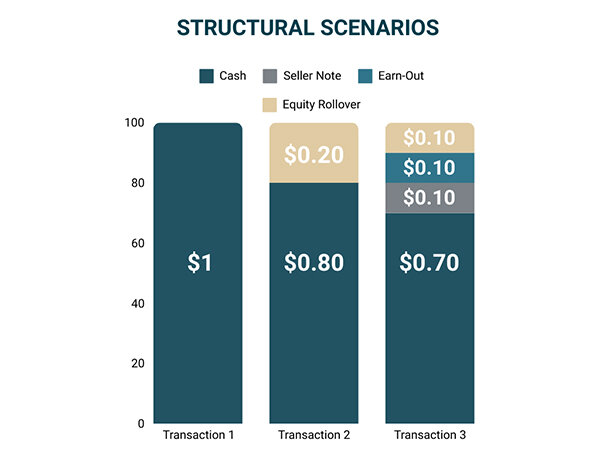

Structure is how the deal is put together financially. It is one thing to say the sale is for $1 and it’s another to say how much of that is cash up front and how much is deferred. Different buyer types will affect this, for example strategic buyers are usually cash rich, while financial buyers (often private equity funds) will usually opt for more complex structures.

There are four main structural components: cash, equity rollover, seller note, and earn-outs. Figure 1 shows how these might make up three different transactions.

-

Transaction one is 100% cash; you receive $1 on the sale

-

Transaction two is 80% cash and an equity rollover of 20%. In this case, you still get a dollar’s worth of value but, only 80% is liquid and 20% of the deal value is rolled into stock of the company you just sold. Buyers do this to align interests and consider it a sign of the seller’s confidence in the company.

-

Transaction three is a combination of all structural components. Here the buyer receives 70% in cash, 10% in equity rollover, 10% in a seller’s note, (a debt that is interest earning and most often cash pay), and 10% in an earn-out (a promise to pay the amount if the company performs as the seller says it will). Needless to say, the more complex your deal, the stronger the legal team you will need.

3) Certainty of Close

The final pillar to bear in mind is all about the probability of the prospective buyer closing on the agreed terms. Here were looking at aspects such as:

-

The buyer’s access to capital

-

Their proven acquisition track record

-

The timing of the fund inclusion

-

Key information provided during the decision-making process

-

Key terms and conditions negotiated in the Letter of Intent

-

Clear and material synergies

-

Competitive tension via the process

-

The buyer’s reputation in the marketplace

It’s about looking beyond the façade and ensuring that time and money isn’t wasted on courting a buyer that isn’t going to come through in the end.

Beyond the three pillars it is vital to remain proactive and solutions driven. Mike Tyson famously said: “Everybody has a plan until they get punched in the mouth.” We all think our company is a good investment, but we need to be prepared to get punched in the mouth. This means getting ready to face and overcome challenges.

Some challenges we’ve seen include double-digit sales declines during the process, material customer concentration leading to the largest customer representing over 75% of revenue; management teams hold owners’ hostage prior to close and many more. There are all sorts of hurdles that we can overcome together, and by being proactive can prevent or limit issues before they start.

We recommend that you take steps such as doing an M&A SWOT analysis, completing a Pre-Mortem analysis and problem-solve and optimize before going to market. We can’t plan for everything, but we can be as ready as possible for all eventualities.

By focusing on the three pillars of valuation, structure, and certainty of close, and maintaining a proactive, solutions-driven approach you can better position yourself for a successful exit.